Citi Shines at Euromoney Awards for Excellence 2024 with Record 41 Wins

Citi is the World’s Best Digital Bank for its best-in-class client platforms

Citi has achieved a remarkable milestone by securing forty-one global, regional, and local market awards from Euromoney, a leading global financial markets magazine, at its annual Awards for Excellence 2024. These awards recognize the best in banking across key areas vital to a bank’s stakeholders, including clients, board members, and executive management teams. The awards considered the performance of the 2023 calendar year.

In its 29th edition, the Euromoney Awards for Excellence honored Citi with titles such as:

- The World’s Best Digital Bank

- The World’s Best Investment Bank in the Emerging Markets

“The range of awards Citi has received from Euromoney is both an honor and affirmation that we are making progress to reach our full potential,” said Tim Ryan, Citi’s Head of Technology and Business Enablement. “Winning the ‘World’s Best Digital Bank Award is a testament to the hard work and dedication of our people that help create a more seamless experience for our clients.”

Citi also received several regional and local market awards, including:

- Asia’s Best Bank for Financing

- Asia’s Best Investment Bank

- Africa’s Best Investment Bank

- CEE’s Best Investment Bank

- Central America and Caribbean’s Best Investment Bank

- Africa’s Best Bank for Transaction Services

- Middle East’s Best Bank for Transaction Services

- Asia’s Best Digital Bank

- Best International Bank in Kazakhstan, Indonesia, Japan, Korea, Pakistan, Dominican Republic, Guatemala, Honduras, Panama

- Best Investment Bank in Ireland, Turkey, Romania, Argentina, Korea, Taiwan

- Best International Investment Bank in Denmark, Italy, Sweden, India, UAE

- Best Bank for Corporates in Brazil, Hong Kong, and The Bahamas

- Best Bank for Diversity and Inclusion in China, Malaysia, Vietnam, and The Philippines

- Brazil’s Best Bank for Corporate Responsibility

- Best Bank and Best Bank for ESG in Costa Rica

- Bahrain’s Best International Islamic Bank

“We are advancing our vision to be the preeminent banking partner for clients with cross-border needs. Our wins validate our commitment to have global conversations with our clients to grow their businesses and seamlessly deliver to them the breadth of products and services across the firm,” said Ernesto Torres Cantú, Citi’s Head of International. “We have shifted our business mix to focus on what we are really good at. We are modernizing the bank, sharpening our focus on risk and controls, and implementing processes to deliver the consistently high level of service our clients expect from Citi across markets.”

Citi’s unified Banking and International organization oversees the local delivery of the full firm’s services to clients in more than 90 markets where Citi has an on-the-ground presence.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

China’s low-consuming, high-investing economy guarantees conflict with other countries

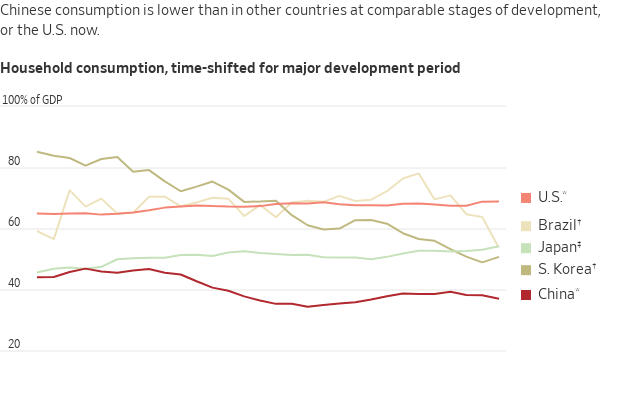

China’s economy is unusual. Whereas consumers contribute 50% to 75% of gross domestic product in other major economies, in China they account for 40%. Investment, such as in property, infrastructure and factories, and exports provide most of the rest.

Lately, that low consumption has become a headwind to China’s growth because property investment, once a major component of demand, has collapsed.

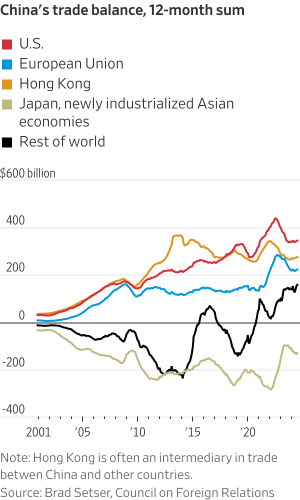

This isn’t just a problem for China; it’s a problem for the whole world. What Chinese companies can’t sell to Chinese consumers, they export. The result: an annual trade surplus in goods now of almost $900 billion, or 0.8% of global gross domestic product. That surplus effectively requires other countries to run trade deficits.

China’s surplus, long a sore spot in the U.S., increasingly is one elsewhere, too. While China’s 12-month trade balance with the U.S. has risen by $49 billion since 2019, it’s up $72 billion with the European Union, $74 billion with Japan and Asia’s newly industrialised economies, and about $240 billion with the rest of the world, according to data compiled by Brad Setser of the Council on Foreign Relations.

Logan Wright , head of China research at Rhodium Group, a U.S. research firm, said China accounts for just 13% of the world’s consumption but 28% of its investment. That investment only makes sense if China takes market share away from other countries, rendering their own manufacturing investment unviable, he said.

“China’s growth model is dependent at this point on a more confrontational approach with the rest of the world,” he said.

While many developing countries relied on investment and exports to fuel early growth, China is an outlier for how low its consumption is, and its sheer size. In a report, Rhodium estimates that if China’s consumption share equaled that of the European Union or Japan, its annual household spending would be $9 trillion instead of $6.7 trillion. That $2.3 trillion difference—roughly the GDP of Italy—is equal to a 2% hole in global demand.

The sources of this underconsumption are deeply embedded in both China’s fiscal systems and its policy choices.

Chinese incomes are highly unequal, and because the rich spend less of their income than the poor, this automatically depresses consumption. Rhodium cites data that says the top 10% of households had 69% of total savings, while a third had negative saving rates.

Other countries address such disparities by taxing the rich more heavily and boosting the spending power of lower and middle classes through cash transfers, and public health and education. China does much less of this. Just 8% of its tax revenue comes from personal income taxes, compared with 38% from value-added taxes, similar to sales taxes, which fall much more heavily on lower-income families, Rhodium estimates.

China also spends less on health and education than major market economies, forcing poor and middle-income families to spend more of their disposable income on both.

Meanwhile, suppressed wages and interest rates depress household income and spending while boosting the profits of state-owned enterprises. The limited taxing authority of local governments forces them to raise revenue by selling property for manufacturing and infrastructure, which further inflates investment.

A decade ago top Chinese policymakers shared Western economists’ perspective that, at the macro level, China needed to rebalance away from investment to consumption. In 2013, the ruling Communist Party said growth would henceforth rely on market forces and consumers.

President Xi Jinping ended up going in the opposite direction; consumption stayed weak while state control over the economy grew. He has replaced reformers with loyalists more preoccupied with sector-specific targets than overall growth.

The bedrock principle behind trade is comparative advantage: countries specialise in what they do best and then export it in exchange for imports. Xi rejects this principle. In pursuit of “independence and self-reliance,” he wants China to make as much and import as little as possible.

Officials in China boast that it is the “only country to produce in every single one of the United Nations’ industrial product categories,” notes Andrew Batson of Gavekal Dragonomics.

Even as China targets advanced products such as electric vehicles and semiconductors, it refuses to surrender market share in lower-value products: “Establish the new before breaking the old,” Xi has instructed his bureaucrats , my colleagues have reported.

As a result, Rhodium argues , “China provides fewer opportunities as an export market for emerging countries while competing head-on with them in the low-tech and mid-tech space.”

Countries that once saw China as a customer now see a competitor. “Many Chinese businesses are manufacturing intermediate goods, which we mainly export,” Rhee Chang-yong , the governor of the Bank of Korea, said last year. “The decadelong support from the Chinese economic boom has disappeared.”

Mexican Finance Minister Rogelio Ramírez de la O complained last month , “China sells to us but doesn’t buy from us and that’s not reciprocal trade.”

Ironically, foreign officials have tended to see the U.S. as the biggest threat to the world trade system, ever since President Donald Trump in 2018 imposed steep tariffs on China and narrower tariffs on other trading partners. He has promised to expand those tariffs if elected this fall.

And yet Trump’s tariffs should be seen as a reaction to China’s beggar-thy-neighbour economic model, one that has proved impervious to existing trade rules.

Still, no single country can fix the problem. Like a dike deflecting floodwaters, U.S. tariffs have diverted Chinese exports to other markets.

Those other countries are now taking action. Mexico, Chile, Indonesia and Turkey have all announced or said they are considering tariffs on China this year. This week Canada announced steep new tariffs on Chinese electric vehicles, steel and aluminum, aligning with those already announced by the U.S.

Yet the world thus far lacks a unified solution to Chinese underconsumption, because China refuses to accept that it’s a problem.

Xi has rejected fiscal support for households as “welfarism” that breeds laziness. In April, Treasury Secretary Janet Yellen complained that China’s “weak household consumption and business overinvestment” were threatening jobs in the U.S. The state news agency Xinhua called it a pretext for protectionism. Earlier this month the International Monetary Fund advised Beijing to spend 5.5% of GDP over four years buying up uncompleted homes. Beijing politely declined.

With China dug in, more friction is sure to follow, and an already fragile world trading system will be stressed to its breaking point.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

Pity the investors in the three artificial-intelligence-themed ETFs that managed to lose money this year.

There are lots of embarrassing ways to lose money, but it is particularly galling to lose when you correctly identify the theme that will dominate the market and manage to buy into it at a good moment.

Pity the investors in the three artificial-intelligence-themed exchange-traded funds that managed to lose money this year. Every other AI-flavored ETF I can find has trailed both the S&P 500 and MSCI World. That is before the AI theme itself was seriously questioned last week, when investor doubts about the price of leading AI stocks Nvidia and Super Micro Computer became obvious.

The AI fund disaster should be a cautionary tale for buyers of thematic ETFs, which now cover virtually anything you can think of, including Californian carbon permits (down 15% this year), Chinese cloud computing (down 21%) and pet care (up 10%). Put simply: You probably won’t get what you want, you’ll likely buy at the wrong time and it will be hard to hold for the long term.

Ironically enough, Nvidia’s success has made it harder for some of the AI funds to beat the wider market. Part of the point of using a fund is to diversify, so many funds weight their holdings equally or cap the maximum size of any one stock. With Nvidia making up more than 6% of the S&P 500, that led some AI funds to have less exposure to the biggest AI stock than you would get in a broad index fund.

This problem hit the three losers of the year. First Trust’s $457 million AI-and-robotics fund has only 0.8% in Nvidia, a bit over half what it holds in cybersecurity firm BlackBerry .

WisdomTree ’s $213 million AI-and-innovation fund holds the same amount of each stock, giving it only 3% in Nvidia.

BlackRock ’s $610 million iShares Future AI & Tech fund was also equal weighted until three weeks ago, when it altered its purpose from being a robotics-and-AI fund, changed ticker and switched to a market-value-based index that gives it a larger exposure to Nvidia.

The result has been a 20-percentage-point gap between the best and worst AI ETFs this year. There is a more than 60-point gap since the launch of ChatGPT in November 2022 lit a rocket under AI stocks—although the ETFs are at least all up since then.

The market has penalized being equal weighted recently, instead rewarding big holdings in the largest stocks.

Jay Jacobs , U.S. head of thematic and active ETFs at BlackRock, says it is best to be market-value weighted when a theme has winner-takes-all characteristics, which he says generative AI has. When the firm’s AI fund included robotics it was spread across a lot more stocks that didn’t compete with each other, so equal weighted made more sense.

For investors, it isn’t so simple. Global X takes the opposite approach with its two $2 billion-plus AI funds, AIQ and BOTZ. BOTZ only buys stocks that focus on AI and robotics, but takes larger positions. AIQ spreads its bets on AI and tech more widely, and its 3% cap on its biggest holdings each time it rebalances means it has far less in Nvidia than BOTZ, with a cap of 8%. AIQ still managed to beat BOTZ this year, though.

So far, so confusing. The basic lesson: Picking among funds within a theme is hard, and depends on luck as well as close reading of the fund’s documents. A more advanced lesson is that it is hard to pick a theme in the first place, or to stick with it. The three problems:

1. Defining the theme is hard . Nvidia features in the anti-woke YALL ETF, which pitches itself as for “God-fearing, flag-waving conservatives.” The chip maker is also held by vegan, gender-diverse and climate-action ETFs. Its shares are clearly driven by the prospects for AI, but it is still big in computer-game and bitcoin ETFs, where its chips were originally used.

2. Timing the theme is even harder. Get in too early, and there aren’t any companies to buy. Get in when the funds are being launched, and the chances are the theme is already widely known and overpriced, as there are typically large numbers of launches during bubbles and late-stage bull markets.

“They are trendy by design,” says Kenneth Lamont, a senior researcher at Morningstar. “They play to our worst instincts, because we’re narrative-driven creatures.”

A recent example was the race to launch clean-energy and early-stage-tech ETFs during the bubble of late 2020 and early 2021. Performance since then has been miserable as prices corrected, with many of the ETFs halving or worse.

Dire timing is common across themes: According to a paper last year by Prof. Itzhak Ben-David of Ohio State University and three fellow academics, what they call “specialized” ETFs lose 6% a year on average over their first five years due to poor launch timing.

3. Long-term investing is pitched by fund managers as the goal for thematic investing, to hang on until the theme bears fruit. But even investors who really want to commit to a theme for the long run often find it hard, as so many funds are wound up, merged or change strategy when they go out of fashion.

The boom in internet funds of the late 1990s vanished after the dot-com bubble burst, with few surviving to see the internet theme blossom a decade later, while six of the 50 “metaverse” funds launched after Facebook switched to Meta Platforms in 2021 have already shut, according to Lamont.

The oldest thematic fund, the DWS Science and Technology mutual fund, started as the Television Fund in 1948 before adding electronics, and has gone through at least four other names. I only have data back to 1973, but it has lagged far behind the wider market since then, despite golden ages for television, electronics, science and now tech. (Yes, it has a lot of Nvidia.)

So what to do? At a very minimum, don’t buy based on the name of a fund. Look at the holdings, look at the index it follows and how it is structured, and consider whether it does what it says. Then think about just how expensive the idea has already become. Watch for the theme coming into fashion and getting overpriced, as that is a good time to sell (or to launch a fund).

But mostly, look at the fees: They will be many times higher than a broad market index fund, and the dismal history of poor timing suggests that for most people they aren’t worth paying.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Interior designer Thomas Hamel on where it goes wrong in so many homes.

Boeing stock has fallen to its lowest level since 2022 after a downgrade from a Wall Street analyst put a number on one of investors’ worst fears: stock dilution.

Wells Fargo analyst Matthew Akers on Tuesday downgraded Boeing stock to the equivalent of Sell from Hold. His price target was reduced to $119 a share from $185.

That is the lowest target price on Wall Street by almost $70 a share, according to FactSet. At $119 a share, down about 30% from recent levels, Boeing would have a market value of roughly $73 billion, levels not seen since early 2020 during the Covid-19 pandemic.

Boeing stock closed down 7.3% at $161.02, while the S&P 500 and Dow Jones Industrial Average were off 2.1% and 1.5%, respectively. It was the lowest close since Nov. 4, 2022, when it finished at $160.01, according to Dow Jones Market Data.

“We think Boeing had a generational free cash flow opportunity this decade, driven by ramping production on mature aircraft and low investment need,” wrote Akers. “But after extensive delays and added cost, we now see growing production cash flow running into a undefined new aircraft investment cycle, capping free cash flow a few years out.”

At this point in its product cycle, Boeing simply should be generating north of $10 billion in free cash flow a year. However, production and quality problems have pushed output lower and added costs. Wall Street sees Boeing using almost $8 billion in cash to fund operations in 2024.

What is more, Boeing likely will need to design a new single-aisle jet in the coming years to better compete with the Airbus A321 family of aircraft. That will take tens of billions of dollars spread out over several years.

Akers sees $30 billion in equity being raised by 2026 to help cover the cost of new investment. Some of that hefty total will go toward repairing Boeing’s balance sheet. The company ended the second quarter with more than $53 billion in long-term debt, up from less than $11 billion at the end of 2018, before the pandemic and significant problems with Boeing’s 737 MAX jet.

Raising $30 billion of equity at recent prices would require issuing roughly 190 million new shares, increasing the share count by about 31%. All things being equal, a higher share count reduces earnings per share.

“If Boeing were to postpone new plane development for several more years (launch early next decade) and instead just pay down debt, we estimate free cash flow per share could grow to about ~$20 late this decade,” added Akers. That might justify a $150 share price in coming years, but postponing a new plane would mean “ ceding significant narrowbody share” to Airbus.

Narrowbody is industry jargon for single-aisle aircraft such as the 737 MAX or A320.

Raising equity and offering customers a new plane, or not offering a new jet and holding off on raising equity: Boeing doesn’t have easy choices to make in coming years.

Overall, 60% of analysts covering Boeing stock rate shares at Buy, according to FactSet. The average Buy-rating ratio for stocks in the S&P 500 is about 55%. Even though Boeing’s Buy-rating ratio is above average, it has been sliding. Coming into the year, before an emergency- door plug blew out in midair on an Alaska Air flight on Jan. 5, the ratio was north of 75%.

The average analyst price target for Boeing shares is about $214.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Following the devastation of recent flooding, experts are urging government intervention to drive the cessation of building in areas at risk.

Multinationals like Starbucks and Marriott are taking a hard look at their Chinese operations—and tempering their outlooks.

For years, global companies showcased their Chinese operations as a source of robust growth. A burgeoning middle class, a stream of people moving to cities, and the creation of new services to cater to them—along with the promise of the further opening of the world’s second-largest economy—drew companies eager to tap into the action.

Then Covid hit, isolating China from much of the world. Chinese leader Xi Jinping tightened control of the economy, and U.S.-China relations hit a nadir. After decades of rapid growth, China’s economy is stuck in a rut, with increasing concerns about what will drive the next phase of its growth.

Though Chinese officials have acknowledged the sputtering economy, they have been reluctant to take more than incremental steps to reverse the trend. Making matters worse, government crackdowns on internet companies and measures to burst the country’s property bubble left households and businesses scarred.

Lowered Expectations

Now, multinational companies are taking a hard look at their Chinese operations and tempering their outlooks. Marriott International narrowed its global revenue per available room growth rate to 3% to 4%, citing continued weakness in China and expectations that demand could weaken further in the third quarter. Paris-based Kering , home to brands Gucci and Saint Laurent, posted a 22% decline in sales in the Asia-Pacific region, excluding Japan, in the first half amid weaker demand in Greater China, which includes Hong Kong and Macau.

Pricing pressure and deflation were common themes in quarterly results. Starbucks , which helped build a coffee culture in China over the past 25 years, described it as one of its most notable international challenges as it posted a 14% decline in sales from that business. As Chinese consumers reconsidered whether to spend money on Starbucks lattes, competitors such as Luckin Coffee increased pressure on the Seattle company. Starbucks executives said in their quarterly earnings call that “unprecedented store expansion” by rivals and a price war hurt profits and caused “significant disruptions” to the operating environment.

Executive anxiety extends beyond consumer companies. Elevator maker Otis Worldwide saw new-equipment orders in China fall by double digits in the second quarter, forcing it to cut its outlook for growth out of Asia. CEO Judy Marks told analysts on a quarterly earnings call that prices in China were down roughly 10% year over year, and she doesn’t see the pricing pressure abating. The company is turning to productivity improvements and cost cutting to blunt the hit.

Add in the uncertainty created by deteriorating U.S.-China relations, and many investors are steering clear. The iShares MSCI China exchange-traded fund has lost half its value since March 2021. Recovery attempts have been short-lived. undefined undefined And now some of those concerns are creeping into the U.S. market. “A decade ago China exposure [for a global company] was a way to add revenue growth to our portfolio,” says Margaret Vitrano, co-manager of large-cap growth strategies at ClearBridge Investments in New York. Today, she notes, “we now want to manage the risk of the China exposure.”

Vitrano expects improvement in 2025, but cautions it will be slow. Uncertainty over who will win the U.S. presidential election and the prospect of higher tariffs pose additional risks for global companies.

Behind the Malaise

For now, China is inching along at roughly 5% economic growth—down from a peak of 14% in 2007 and an average of about 8% in the 10 years before the pandemic. Chinese consumers hit by job losses and continued declines in property values are rethinking spending habits. Businesses worried about policy uncertainty are reluctant to invest and hire.

The trouble goes beyond frugal consumers. Xi is changing the economy’s growth model, relying less on the infrastructure and real estate market that fueled earlier growth. That means investing aggressively in manufacturing and exports as China looks to become more self-reliant and guard against geopolitical tensions.

The shift is hurting western multinationals, with deflationary forces amid burgeoning production capacity. “We have seen the investment community mark down expectations for these companies because they will have to change tack with lower-cost products and services,” says Joseph Quinlan, head of market strategy for the chief investment office at Merrill and Bank of America Private Bank.

Another challenge for multinationals outside of China is stiffened competition as Chinese companies innovate and expand—often with the backing of the government. Local rivals are upping the ante across sectors by building on their knowledge of local consumer preferences and the ability to produce higher-quality products.

Some global multinationals are having a hard time keeping up with homegrown innovation. Auto makers including General Motors have seen sales tumble and struggled to turn profitable as Chinese car shoppers increasingly opt for electric vehicles from BYD or NIO that are similar in price to internal-combustion-engine cars from foreign auto makers.

“China’s electric-vehicle makers have by leaps and bounds surpassed the capabilities of foreign brands who have a tie to the profit pool of internal combustible engines that they don’t want to disrupt,” says Christine Phillpotts, a fund manager for Ariel Investments’ emerging markets strategies.

Chinese companies are often faster than global rivals to market with new products or tweaks. “The cycle can be half of what it is for a global multinational with subsidiaries that need to check with headquarters, do an analysis, and then refresh,” Phillpotts says.

For many companies and investors, next year remains a question mark. Ashland CEO Guillermo Novo said in an August call with analysts that the chemical company was seeing a “big change” in China, with activity slowing and competition on pricing becoming more aggressive. The company, he said, was still trying to grasp the repercussions as it has created uncertainty in its 2025 outlook.

Sticking Around

Few companies are giving up. Executives at big global consumer and retail companies show no signs of reducing investment, with most still describing China as a long-term growth market, says Dana Telsey, CEO of Telsey Advisory Group.

Starbucks executives described the long-term opportunity as “significant,” with higher growth and margin opportunities in the future as China’s population continues to move from rural to suburban areas. But they also noted that their approach is evolving and they are in the early stages of exploring strategic partnerships.

Walmart sold its stake in August in Chinese e-commerce giant JD.com for $3.6 billion after an eight-year noncompete agreement expired. Analysts expect it to pump the money into its own Sam’s Club and Walmart China operation, which have benefited from the trend toward trading down in China.

“The story isn’t over for the global companies,” Phillpotts says. “It just means the effort and investment will be greater to compete.”

Corrections & Amplifications

Joseph Quinlan is head of market strategy for the chief investment office at Merrill and Bank of America Private Bank. An earlier version of this article incorrectly used his old title.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

A key recommendation of the IMF’s Enhanced General Data Dissemination System (e-GDDS).

Bahrain has taken a major step in advancing data transparency with the recent launch of its National Summary Data Page (NSDP). This initiative, which went live on Thursday, fulfills a key recommendation from the IMF’s Enhanced General Data Dissemination System (e-GDDS) by publishing critical macroeconomic and financial data.

The e-GDDS is the foundational tier of the IMF’s Data Standards Initiatives, designed to promote transparency and encourage countries to voluntarily share timely data that is vital for monitoring and analyzing economic performance, the IMF noted in a statement. Bahrain’s adoption of these recommendations and the creation of the NSDP underscore the nation’s commitment to improving data accessibility and transparency.

The NSDP will serve as a centralized hub for national and international stakeholders, investors, rating agencies, and decision-makers, offering easy access to vital economic and financial data. According to the IMF’s Executive Board, this transparency is essential for tracking a country’s economic and financial developments. Additionally, the standardized data format supports cross-country economic analysis and early detection of risks, helping to prevent economic crises and promoting sustainable growth.

Bert Kroese, Chief Statistician and Data Officer at the IMF, praised this achievement, expressing confidence that Bahrain will benefit from utilizing the e-GDDS framework to further develop its statistical system. The IMF Executive Board has recently reviewed the advantages of participating in the e-GDDS, including improved sovereign financing conditions.

Bahrain’s NSDP consolidates data on national accounts, government operations, the monetary and financial sector, and the external sector in one accessible platform. With machine-readable formats and a scheduled release of data, it ensures timely and simultaneous access for all users. Data for the NSDP is provided by the Ministry of Finance and National Economy, the Central Bank of Bahrain, and the Information and eGovernment Authority.

This launch also signals Bahrain’s future intention to subscribe to the IMF’s Special Data Dissemination Standard (SDDS), further reinforcing its dedication to data transparency. The NSDP is now accessible via the IMF’s Dissemination Standards Bulletin Board.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

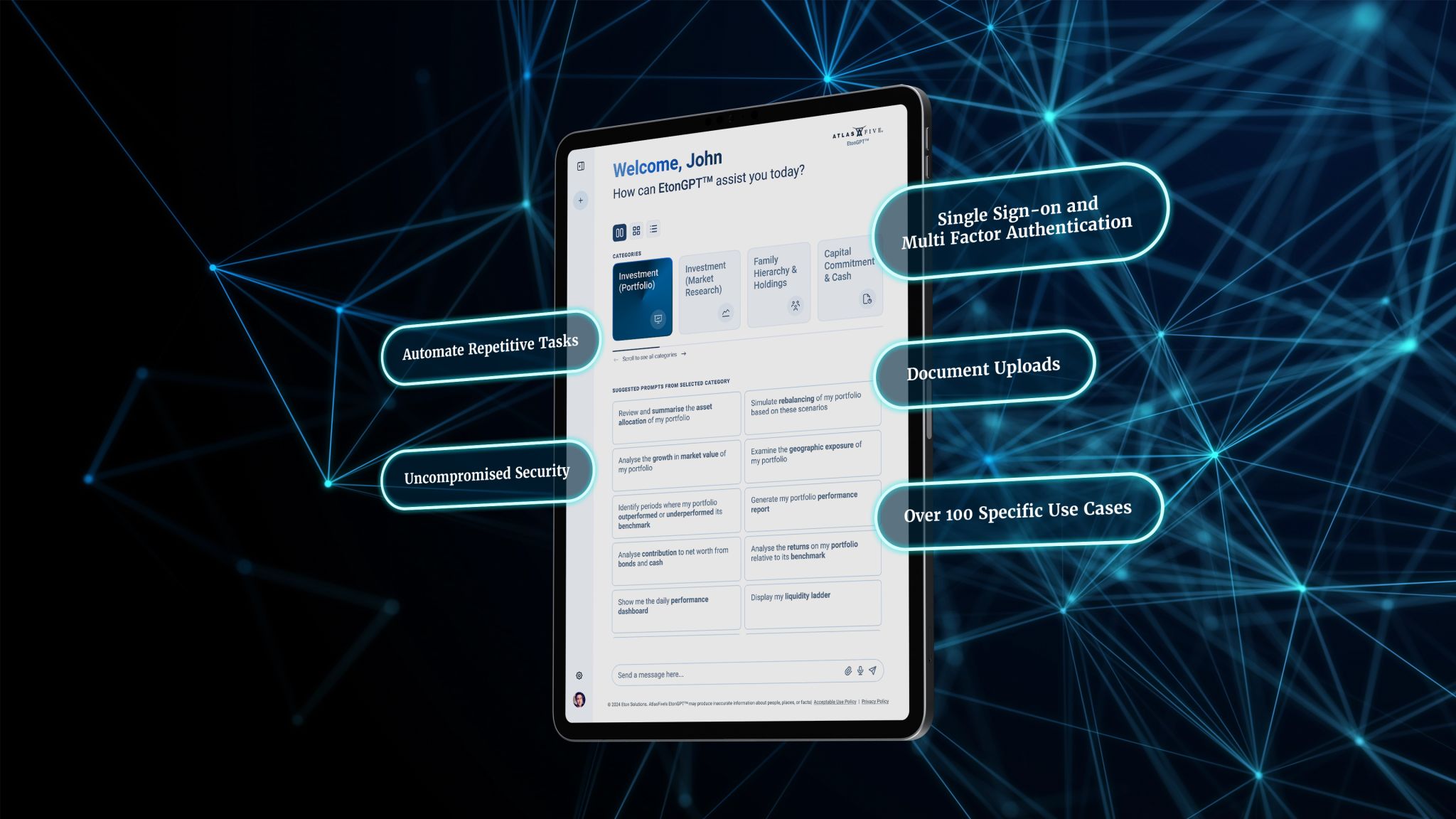

EtonGPT™ will enable wealth managers to achieve 2 to 4X increase in operational efficiency.

Eton Solutions has launched EtonGPT™, the world’s first generative AI module tailored specifically for family offices worldwide. EtonGPT™ seamlessly combines the robust transactional capabilities of Eton Solutions’ ERP platform with advanced conversational AI features.

This technology will be available exclusively to users of AtlasFive®, enabling the majority of the 750 families on the platform to leverage EtonGPT™ to enhance the productivity and efficiency of their family offices. By integrating document data with transactional data stored in AtlasFive®, EtonGPT™ streamlines operations and drives productivity improvements.

Several clients of Eton Solutions, including Shade Tree Advisors (US), Todd Family Office (New Zealand), and Aglaia Family Office (Singapore), are already utilizing this AI-powered platform to access information and conduct detailed analyses of their investment and asset portfolios. EtonGPT™ serves as both an internal search engine and a data extraction tool within the secure, cloud-based AtlasFive® ERP platform.

With pending patents, this hybrid AI platform integrates various cutting-edge AI technologies, including machine learning, expert system-based business rule engines, and large language models. It delivers superior accuracy and insights through AI-driven data extraction, summarization, inference, and transformation, empowering family offices to operate more efficiently and securely.

Satyen Patel, Eton Solutions’ executive chairman said, “Our AtlasFive® solution was the first to offer a centralized data platform that had integrated structured data processing across accounting, investment and tax functions. With the launch of EtonGPT™, the world’s first family office LLM, we are embracing cutting-edge technology and reshaping the future of family office management across the globe. AI is increasingly being deployed across businesses. While family offices have largely remained rooted in manual processes, with the integration of AI, they will undergo an unparalleled change, making them resilient and future-ready”.

“With EtonGPT™, AtlasFive® can now parse and integrate data buried in more than 250 document types such as trust plans, estate plans and partnership agreements. This combination of structured and unstructured data processing offers wealth managers the ability to gain a 2 to 4X increase in operational efficiency.”

“EtonGPT™ will offer a foundational shift platform enabling family offices to elevate their legacy, strengthen corporate governance, and provide high value to the HNWIs and UHNWIs they serve.”

Timothy C. Macherone, Chief Operating Officer of Shade Tree Advisors LLC, said, “I do not doubt that EtonGPT™ can be a potential game-changer. In deploying the AI-based technology, which involved leveraging EtonGPT™ to automate our document organization and retention processes, we reduced human involvement by 50% and met our accuracy goals. Similarly, we see countless opportunities to unlock efficiencies in our legacy processes through the use of EtonGPT™ in many verticals, including calculating and posting mark-to-markets on private investments, logging invoice information, and summarizing estate planning documents.”

Andrew Hull, Chief Executive of Todd Family Office, said, “AI is reshaping how we do everything at the Todd Family Office, and our partnership with Eton Solutions has been beneficial. We have faced challenges in fixing AI hallucinations and are worried about the potential misuse of these tech marvels. We’re working with Eton Solutions to pioneer a Responsible AI framework that harnesses the full power of AI with transparency, ethics, and trust at its core. Together, we’re setting the standard for the future of AI for family offices.”

Stephen Hunt, Chief Executive Officer of Aglaia Family Office Pte. Ltd., said, “Aglaia Family Office is proud to be pioneering the setup of automated and AI-powered consolidated portfolio reporting and analytics solutions in Asia. Our commitment goes beyond just automation—we’re focused on the responsible use of AI, ensuring that its integration into our operations enhances not only efficiency but also strengthens timeliness and accuracy. EtonGPT’s early success reassures us that, with Eton Solutions, we’re on the right path.”

As AI’s power is increasingly integrated into modern organizations, Eton Solutions recognizes cybersecurity challenges from traditional threats such as phishing, malware, and data breaches are expanding to include AI-based risks such as deepfakes, misuse, and algorithmic bias. To lessen or mitigate these risks, Eton Solutions is working with its Customer Advisory Board to introduce frameworks that encompass ethics, safety, transparency, trust, and security.

EtonGPT™ is designed to ensure a robust, secure, and ethical environment for family office operations.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

The positive economic outlook and improving asset quality continue to support the willingness of financial institutions to lend

The Central Bank of the UAE (CBUAE) has reported a rise in demand for bank credit across the country, driven by economic stability and robust investments, even in the face of increasing interest rates.

In its Credit Sentiment Survey for Q2 2024, the CBUAE highlighted that the positive economic outlook and improving asset quality continue to support the willingness of financial institutions to lend.

The survey findings suggest that this strong credit demand is expected to persist into the third quarter of this year. The CBUAE also noted that the construction sector saw the highest growth in credit demand during Q2, followed by manufacturing, real estate development, and retail and wholesale trade.

Trade credit demand remained strong throughout the second quarter, with an increased appetite for lending across all loan categories and industry sectors, particularly from large government entities and major corporations.

The survey further indicated that all emirates experienced a significant rise in credit demand during Q2, with expectations that this trend will continue over the next three months, particularly in the construction, real estate, manufacturing, retail, and wholesale sectors.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

The ranking is based on an online survey that garnered opinions from expatriates from over 170 countries.

InterNations has recently published its Expat Insider 2024 rankings, highlighting the top destinations for expatriates across several key sectors. The online survey gathered insights from expats residing in over 170 countries, offering a broad perspective on the global expat experience.

Qatar stands out in the rankings, securing the fourth place in the Quality-of-Life category. It also earned top-five positions in crucial areas such as Healthcare, Safety & Security, Travel & Transit, and Career Prospects, showcasing the country’s appeal as a prime destination for expatriates.

With over 12,500 expats from 175 nationalities, spanning 174 countries, participating in the survey, the data provides a detailed look at what makes Qatar a leading choice for expats.

Quality of Life

In the global Quality of Life rankings, Qatar placed fourth, following the UAE, Austria, and Spain. This ranking takes into account five subcategories: Healthcare, Travel & Transit, Safety & Security, Environment & Climate, and Leisure Options.

Healthcare

Qatar’s healthcare system received high praise from expats, placing the country second globally in this category, just behind South Korea. Expats highlighted the quality, accessibility, and affordability of medical care as key factors in their positive assessment.

Travel & Transit

Qatar’s efficient transportation network also drew attention, securing the third spot globally, following Austria and Singapore. Expats were particularly impressed with the affordability and availability of public transport, as well as the ease of navigating the country on foot or by bicycle.

Safety & Security

Safety and political stability are often key considerations for expats when choosing a destination, and Qatar ranked fifth in the Safety & Security category. With expats reporting a strong sense of personal safety, Qatar sits among the world’s safest countries, following the UAE, Switzerland, Luxembourg, and Denmark.

Environment & Climate

In the Environment & Climate category, Qatar ranked 27th globally. While the country topped in other areas, the expats surveyed shared mixed views on air quality, climate, and the balance between natural and urban environments. Costa Rica topped this particular category.

Leisure Options

For those seeking leisure and recreational activities, Qatar offers plenty, securing 13th place globally in this category. Expats appreciated the country’s culinary diversity, cultural offerings, and local nightlife. However, Spain took the lead in this segment.

Additional Rankings

Qatar also featured prominently in other surveys. In the “Best Destinations for Expats in 2024” list, Qatar ranked 17th overall. Additionally, in the “Working Abroad” survey, the country placed 19th, with notable highlights including a 5th place ranking for Career Prospects and 11th for Salary and Job Security.

These rankings reinforce Qatar’s growing reputation as a top destination for expatriates, offering a high standard of living, excellent career opportunities, and a safe, vibrant environment. The country’s continued development across sectors ensures that it remains a key player in the global expat landscape.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Building on the success of its first two editions, this year’s competition promises enhanced opportunities for startups, with a focus on leveraging LBS’s global network and resources.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Protego is now live as a fully operational subsidiary, supported by RAKBANK.

Protego, an innovative insurance aggregator platform, is set to transform the way insurance is managed in the UAE. Now fully operational as a subsidiary supported by RAKBANK, Protego offers a streamlined approach for residents to buy, manage, and claim insurance policies.

The platform provides real-time quotes, quicker coverage, secure payments, and personalized experiences across car, travel, and home insurance. By integrating seamlessly with leading insurance providers, Protego makes securing the right coverage easier and more secure than ever before.

Raheel Ahmed, RAKBANK Group CEO, shared his thoughts on this milestone: “Efficiency, convenience, and security are at the heart of modern insurance services. Protego delivers on these fronts, making it simple for users to compare a wide range of insurance options with real-time prices and policies. It’s all about providing a transparent, user-friendly experience that empowers customers to make informed decisions.”

Protego’s platform is built on cutting-edge APIs, allowing customers to access real-time quotes in just 60 seconds. With a blend of digital tools and expert guidance, Protego makes insurance straightforward, putting control directly into the hands of the customer.

Lee Koy Nien, Executive Vice President & Head Bancassurance, added: “At Protego, simplicity and transparency are our guiding principles. We’re here to demystify insurance, offering solutions that are easy to understand and tailored to individual needs. Protego is about bringing peace of mind, backed by advanced technology and the support of our expert team.”

Protego isn’t just another insurance platform it’s an ecosystem designed from the ground up, leveraging state-of-the-art technology to deliver services like AI-powered claims notifications and roadside assistance. Customers can also securely store and manage their policies through a unique digital folder and e-Vault, ensuring their important documents are always safe and accessible.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Through this strategic partnership, InvestGB and Gulf Bank’s clients will have the opportunity to invest in curated investment offerings across key real estate sectors

In its ongoing commitment to offering premier investment opportunities, Gulf Capital Investment Company (InvestGB), the fully-owned investment subsidiary of Gulf Bank, has formed a strategic partnership with Investcorp, a globally renowned alternative investment manager. This collaboration will enable InvestGB and Gulf Bank’s extensive client base to tap into Investcorp’s diverse real estate investment portfolios.

Through this partnership, clients of InvestGB and Gulf Bank will have the chance to invest in specialized offerings across critical real estate sectors, including multifamily, industrial, and student housing. Investcorp’s multifamily portfolio provides exposure to a broad range of residential properties in high-potential markets, aligning with the investment goals of InvestGB and Gulf Bank clients.

Additionally, Investcorp’s industrial portfolio offers clients the opportunity to benefit from the adaptability and significant growth of industrial assets, known for their resilience. The student housing sector presents a unique opportunity with its stable occupancy rates, granting InvestGB and Gulf Bank client’s access to this asset class.

Commenting on this partnership, Noorah AlSane, Managing Director of Real Estate Investments at InvestGB said, “This strategic partnership aligns perfectly with our commitment to providing our clients with innovative and diversified investment solutions”.

AlSane added, “Investcorp’s strong reputation and expertise in real estate make them the ideal partner for offering these exclusive investment opportunities to our valued clients.”

Mohamed AlSada, Managing Director of Private Wealth- Bahrain and Kuwait Markets at Investcorp expressed his delight on this strategic partnership, “This partnership leverages Investcorp’s global investment expertise and proven track record in these sectors, and offers InvestGB and Gulf Bank clients with access to our best-in-class real estate investment offerings.

AlSada added, “This strategic partnership with InvestGB will provide its valued clients with access to our best real estate investment offers and will ensure an array of benefits for both parties, as it allows InvestGB to benefit from Investcorp’s global expertise in the real estate investments sector and its extensive track record in real estate investment. It also provides us with the opportunity to access InvestGB’s wide client base and partner with Gulf Bank, one of Kuwait’s leading banks.”

InvestGB is a closed Kuwaiti shareholding company with a capital of 10 million Kuwaiti Dinars and provides a comprehensive range of leading and innovative services segmented into Wealth Management, Asset Management, Investments, and Investment Advisory for high-net-worth individuals and institutional investors. Guided by a seasoned team of investment professionals, InvestGB adheres to the highest ethical standards, one of its core values.

InvestGB aims to build a robust investment management platform for its clients and Gulf Bank’s clients, contributing to the Bank’s revenue and profits through a solid investment strategy and innovative offerings. The company seeks to expand its strategic relationships with top-tier firms and strengthen Kuwait’s image as a business destination for foreign investors.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

The revised rules will remove the need for numerous licenses and prior approvals

The Saudi Ministry of Investment has announced new, streamlined investment rules designed to facilitate foreign investment in Saudi Arabia.

These updated regulations are part of an effort to attract more international investors by simplifying the investment process and creating a more favorable business environment.

The ministry emphasized that the revised rules will remove the need for numerous licenses and prior approvals, significantly cutting down on paperwork and reducing bureaucratic obstacles.

The full details of these new regulations are expected to be released by the end of September, with implementation scheduled for early 2025.

Approved by the Saudi Council of Ministers, this updated investment framework is a crucial component of the national investment strategy and is aligned with Saudi Vision 2030, underscoring the critical role of investment in achieving comprehensive development goals and diversifying the nation’s economic resources.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Alexandre de Betak and his wife are focusing on their most personal project yet.

Saudi youth will have the opportunity to receive world-class tuition at EWA’s dedicated training center.

NEOM Green Hydrogen Company (NGHC) and the Energy & Water Academy (EWA) have announced a strategic collaboration to launch a specialized vocational training program designed to equip Saudi nationals with the skills and expertise needed to support the operation, maintenance, and optimization of the green hydrogen plant. This program will also enable participants to excel in the rapidly expanding green hydrogen sector. Marking a significant milestone, this is the first green hydrogen training initiative of its kind in the Kingdom.

NGHC is on track to become the world’s largest green hydrogen producer, with full operations expected by the end of 2026. As a pioneer in this industry, NGHC is making substantial investments in the training and upskilling of its workforce within the Kingdom, ensuring they possess the necessary skills, knowledge, and hands-on experience to lead this transformative project. The partnership between NGHC and EWA is in alignment with Saudi’s Vision 2030, which aims to position the country as a global leader in renewable energy, sustainable development, and clean hydrogen production by 2030.

The comprehensive training program, supported by the Saudi Human Resources Development Fund, commenced in August at EWA in the city of Rabigh in Saudi Arabia, and is tailored for aspiring male and female technicians and engineers. The program offers a unique opportunity to gain practical knowledge and hands-on experience on-site in renewable energy technology and green hydrogen production. The program will offer:

- 2 Year Technician Training Program in Renewable Energy Technology & Green Hydrogen: This program targets recent graduates of Industrial Technical Colleges with Diploma Certificates or a Bachelor’s Degree in Science and provides specialized training in Renewable Energy technology and green hydrogen.

- 1 Year Engineers Training Program: Designed for individuals holding a Bachelor’s degree in engineering, this program provides specialized training in Renewable Energy technologies.

Trainees will also receive a stipend while on the program, combining academic rigor with practical application. Trainees will benefit from:

- World-class Instruction: EWA’s expert faculty will deliver a curriculum aligned with industry best practices.

- State-of-the-art Facilities: Access to cutting-edge equipment and technology at EWA’s dedicated training center.

- Comprehensive Support: Accommodation and meals will be provided to ensure a seamless learning experience.

- On-the-job training: Trainees will be able to apply their new skills and knowledge while taking part in the day-to-day operations of the plant.

Wesam Y. Alghamdi, CEO of NEOM Green Hydrogen Company, said: “Investing in education and training is crucial for the success of NEOM Green Hydrogen Company as we start preparing to operate the renewable energy facilities and the green hydrogen production plant and supporting the broader clean hydrogen revolution in Saudi Arabia. This program in partnership with EWA will empower a new generation of skilled professionals to lead this exciting nascent industry into the future.

“This program goes beyond traditional training, providing hands-on experience with cutting-edge technology and a comprehensive understanding of green hydrogen production, and we are confident that graduates will be highly sought-after by industry leaders.”

Tariq Al Shamrani, CEO of the Energy & Water Academy, said: “Our mission at EWA is to cultivate a generation of innovators and leaders equipped to drive Saudi Arabia’s vision for a sustainable future. This partnership with NGHC reflects our dedication to advancing education that not only meets but exceeds industry demands, ensuring our trainees are at the forefront of the global energy transition.”

The program serves as a model for industry-academic collaboration in tackling the challenges of climate change and building a more sustainable future. Aspiring technicians and engineers are encouraged to explore these unique training opportunities and join the movement towards Saudi Arabia’s economic diversification goals while supporting the global transition to clean energy solutions.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Sydney’s prestige market is looking up, here’s three of the best on the market right now.

The meeting explored ways to further strengthen bilateral relations and expand cooperation across multiple areas.

Saudi Minister of Foreign Affairs Prince Faisal bin Farhan and Qatar’s Prime Minister and Minister of Foreign Affairs Sheikh Mohammed bin Abdulrahman Al-Thani co-chaired the Executive Committee meeting of the Saudi-Qatari Coordination Council in Riyadh on Sunday. The session focused on further strengthening bilateral ties and cooperation across various sectors.

Prince Faisal opened the meeting by welcoming Sheikh Mohammed and his delegation to Saudi Arabia, wishing them a pleasant stay. He emphasized that the gathering was aimed at enhancing bilateral relations, aligning with the aspirations of the leadership and citizens of both nations, and expanding their cooperation to new horizons.

Prince Faisal highlighted the importance of the Coordination Council as a framework for advancing work in all fields, reinforcing fraternal relations, and supporting the Visions 2030 of both Saudi Arabia and Qatar, which would benefit both countries and their peoples.

In his remarks, the Qatari Prime Minister commended the efforts of the Council’s committees in updating initiatives, creating new ones, and establishing measurable and actionable milestones, complete with timelines.

Sheikh Mohammed emphasized that this meeting marked a significant step in the deepening of bilateral relations and reaffirmed the commitment of both nations to working closely together, in line with the directives of their leaders. He expressed his anticipation for the successful implementation of the Council’s plans.

“Today we are witnessing the fruits of the great efforts made by the heads of the sub committees, their working teams, liaison officers and the General Secretariat team since the beginning of the 8th session of the Qatari-Saudi Coordination Council, as this session is responsible for many files of joint cooperation between us that we seek to accomplish and continue the work process with strength and determination to achieve the desired results,” Sheikh Mohammed stated, reaffirming Qatar’s commitment to ongoing collaboration that meets the expectations of both countries’ leaderships and peoples.

The General Secretariat team presented a review of the preparatory work carried out by the Council’s subcommittees and their teams. The meeting concluded with Prince Faisal and Sheikh Mohammed signing the minutes of the Executive Committee session.

The meeting was also attended by Saudi Minister of Finance, Mohammed Al-Jadaan and Director General of the General Administration of Secretariats of Councils and Committees at the Ministry of Foreign Affairs, Eng. Fahad Al-Harthy.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Beyon Money’s Checkout Payment solution will be available on the Binance App.

Beyon Money has formed a strategic partnership with Binance, the world’s leading cryptocurrency exchange by trading volume, to offer exclusive benefits and services. This collaboration will integrate Beyon Money’s Checkout Payment solution into the Binance App, allowing customers to top up their Binance wallet directly from their Beyon Money Wallet using their mobile number registered with Beyon Money, bypassing the need for payment card details. Furthermore, the partnership will introduce special offers exclusively for Beyon Money customers.

Beyon Money CEO Roberto Mancone commented, “Beyon Money is delighted to partner with Binance to deliver its embedded Beyon Money Checkout Payment solution. This is the first C2B (Consumer to Business) wallet to wallet top up solution with high security, best User Experience, instant transfer and lowest cost for the clients of Beyon Money and Binance.”

Tameem Al Moosawi, Binance Bahrain’s General Manager said: “This collaboration between two regulated entities by the Central Bank of Bahrain marks a significant step forward in our mission to make crypto assets and payments more accessible and cost-effective for users.”

“By integrating Beyon Money Checkout Payment solution into the Binance App, we are not only seamlessly simplifying the process but also ensuring that our customers benefit from the lowest transaction fees in the market.”

Beyon Money’s Checkout solution, which enables merchants to accept payments at reduced costs, is reshaping the landscape of merchant services in Bahrain, and Middle Eastern regions. Furthermore, it continues Beyon Money’s mission to be a partner of choice within the financial ecosystem in Bahrain and beyond.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Self-tracking has moved beyond professional athletes and data geeks.