Mazad and Kanoo Announce Strategic Partnership to Enhance Auction Services in Bahrain and Gulf Region

Kanoo Real Estate will provide access to its diverse portfolio of high-value assets and equipment

Mazad, a local portfolio company of Bahrain Mumtalakat Holding Company (“Mumtalakat”), is delighted to announce a strategic partnership with Kanoo Real Estate, a subsidiary of the Yusuf bin Ahmed Kanoo Group, one of the region’s leading business conglomerates.

Under this partnership, Kanoo Real Estate will provide Mazad with access to its diverse portfolio of high-value assets and equipment, enhancing Mazad’s asset inventory and solidifying its position as the premier auction destination in Bahrain and the wider Gulf region.

“We are thrilled to be partnering with Kanoo Real Estate, which is a part of the Yusuf Bin Ahmed Kanoo Group, a pioneer in the regional business landscape,” said Talal Alaraifi CEO of Mazad. “Their extensive asset and business portfolio will be invaluable as we continue to grow our network and bring even more exceptional offerings to discerning buyers and investors in Bahrain and beyond.”

This partnership is mutually beneficial, allowing both organizations to leverage each other’s established relationships and industry insights, thereby enhancing the reach, variety, and quality of Mazad’s auctioning services.

Commenting on the occasion, Mr. Talal Fawzi Kanoo, Chairman of Kanoo Real Estate said: “We are thrilled to collaborate with Mazad, to further elevate the auction experience in the Kingdom of Bahrain. Through this partnership with Mazad, who continue to set the standard in the auctioning industry, we aim to enhance the local auction market by offering some of the most sought-after essential assets through an exceptional auctioning platform.”

Meanwhile, Mr. Mohamed Abdulelah Al Kooheji, Chief Executive Officer of Kanoo Real Estate, stated: “We are proud to join forces with Mazad, a renowned pioneer in the auction industry. This strategic partnership allows us to curate an exceptional auction experience, offering top-tier assets to the local market through an innovative and user-friendly auction platform.”

Further details about the specific initiatives and plans under this partnership will be announced in the coming weeks.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

This will help developers navigate the competitive landscape.

Engel & Völkers Middle East has introduced its new Development Services department, designed to address the distinct requirements of developers, builders, and investors in the region.

As Dubai’s real estate market continues to grow at a rapid pace, the need for specialized services to help developers navigate this highly competitive sector is more crucial than ever. Engel & Völkers Development Services is equipped to provide expert guidance throughout every phase of the development process, from land acquisition and project conceptualization to sales, marketing, and branding strategies.

Daniel Hadi, CEO of Engel & Völkers Middle East, emphasized the importance of this launch, stating, “As Dubai’s real estate market continues to grow with new launches happening daily, we saw the growing need for a specialized service that could help developers navigate this competitive landscape. The timing is ideal for our Development Services department to offer the expertise required to create projects that not only stand out but also meet the high standards of quality and innovation that the market demands.”

“Our focus is on partnering with those who are committed to building a reputation for excellence in the industry. Whether it’s an emerging developer with a great vision or an established firm looking to build their portfolio, Engel & Völkers Development Services is equipped to provide the guidance and support necessary to bring their projects to life with exceptional results,” added Hadi.

The new department stands apart within Engel & Völkers by offering a comprehensive range of services that cater specifically to the needs of developers. Unlike the Residential and Commercial divisions, which focus on sales and rental transactions, Engel & Völkers Development Services provides expert guidance throughout the entire development process. This includes strategic planning, market analysis, and innovative marketing approaches, ensuring that each project not only meets but exceeds market expectations.

This is a strategic extension of Engel & Völkers Middle East’s mission to be the leading consultant in all aspects of real estate. By introducing this department, the company is leveraging decades of experience in both the residential and commercial sectors to provide comprehensive support to real estate developers. This new division will solidify Engel & Völkers’ position as the go-to partner for all real estate needs in the region, contributing to the sustainable growth and development of the Middle East’s real estate landscape.

Engel & Völkers Middle East’s Development Services department is committed to setting new standards for quality, innovation, and profitability in the UAE’s real estate market. The division aims to drive a shift towards more thoughtful, well-executed developments that align with market demands and consumer expectations.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Americans now think they need at least $1.25 million for retirement, a 20% increase from a year ago, according to a survey by Northwestern Mutual

The Republican nominee says it would help bring down home prices, though these buyers account for a fraction of U.S. home sales

Former President Donald Trump said he would ban undocumented immigrants from obtaining home mortgages, a move he indicated would help ease home prices even though these buyers account for a tiny fraction of U.S. home sales.

Home loans to undocumented people living in the U.S. are legal but they aren’t especially common. Between 5,000 and 6,000 mortgages of this kind were issued last year, according to estimates from researchers at the Urban Institute in Washington.

Overall, lenders issued more than 3.4 million mortgages to all home purchasers in 2023, federal government data show.

Trump, the Republican presidential nominee, made his comments Thursday during a policy speech to the Economic Club of New York in Manhattan.

Housing remains a top economic issue for voters during this presidential election. Rent and home prices grew at historic rates during the pandemic and mortgage rates climbed to levels not seen in more than two decades. A July Wall Street Journal poll showed that voters rank housing as their second-biggest inflation concern after groceries.

Both major candidates for the 2024 presidential election have made appeals to voters on housing during recent campaign stops, though the issue has so far featured more prominently in Vice President Kamala Harris ’s campaign.

Trump has blamed immigrants for many of the nation’s woes, including crime and unemployment. Now, he is pointing to immigrants as a cause of the nation’s housing-affordability crisis. Yet some affordable-housing advocates and real-estate professionals said Trump’s mortgage proposal would fail to bring relief to priced-out home buyers.

“It’s unfortunate that given the significant housing affordability crisis that is widely acknowledged across most partisan lines, we are arguing about a minuscule segment of the market,” said David Dworkin, president of the National Housing Conference, an affordable-housing advocacy group.

Gary Acosta, chief executive of the National Association of Hispanic Real Estate Professionals, a trade organization, said, “It’s just another effort to vilify immigrants and to continue to scapegoat them for any issues that we have here in the United States.”

A Trump campaign spokeswoman didn’t immediately respond to a request for comment.

Undocumented immigrants in the U.S. can obtain an obscure type of mortgage designed for taxpayers without Social Security numbers, most of whom are Hispanic. The passage of the USA Patriot Act of 2001 allowed banks to use identification numbers from the Internal Revenue Service as an alternative to Social Security, extending a number of financial services to people without legal status for the first time.

Mortgage loans for undocumented immigrants are typically higher interest and borrowers include legal residents who have undocumented spouses, Acosta said. Lenders include regional credit unions and community-development financial institutions.

In his speech, Trump said that “the flood” of undocumented immigrants is driving up housing costs. “That’s why my plan will ban mortgages for illegal aliens,” he said.

Trump didn’t elaborate on how he would enact a ban on such loans.

Though mortgages for undocumented people living in the U.S. are relatively rare, residential real-estate purchases by foreign nationals are big business , especially in expensive coastal cities such as New York and Los Angeles. These sales have declined in recent years, however.

Close to half of foreign purchases are made by people residing abroad, while the other half are made by recent immigrants or residents on nonimmigrant visas, according to an annual survey by the National Association of Realtors. Many affluent foreigners buy U.S. homes with cash instead of obtaining mortgage financing.

In his Thursday speech, which focused mostly on other economic matters such as energy and taxation, Trump proposed other measures to bring down housing costs, including cutting regulations for builders and allowing more building on federal land. Similar ideas appeared in the housing policy outline Harris released in August .

The former president has spoken on housing-related issues in speeches at other recent campaign stops, including in Michigan last month, where he touted his administration’s 2020 overturn of a policy that had encouraged cities to reduce racial segregation .

“I keep the suburbs safe,” Trump said. “I stopped low-income towers from rising right alongside of their house. And I’m keeping the illegal aliens away from the suburbs.”

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Interior designer Thomas Hamel on where it goes wrong in so many homes.

Offering a distinctive mix of investment opportunities across residential and hospitality segments.

Ras Al Khaimah (RAK) is quickly gaining recognition as a premier destination for real estate investors in the UAE, offering a distinctive mix of natural beauty, strategic positioning, and forward-looking development strategies.

The emirate’s real estate sector is on the cusp of a major growth phase, presenting a range of investment opportunities across both residential and hospitality markets, with the promise of strong returns and a high quality of life.

In the last 12 months, RAK has seen a consistent rise in property values, delivering impressive returns on investment. Apartment capital values have climbed by as much as 35%, with internal rates of return (IRR) ranging from 20% to 30%.

Al Marjan Island has emerged as a particularly desirable area, providing rental yields above 9%, outpacing other emirates. This shift highlights RAK’s increasing appeal to investors seeking lucrative returns in less saturated markets, solidifying its position as a key destination for maximizing real estate investments.

Oliver Mitri, Co-Founder of Imobiliare Dubai, which has been at the forefront of promoting RAK’s real estate potential to the global market, says, “Ras Al Khaimah offers a fresh perspective for real estate investors, combining high returns with untapped potential. The emirate’s strategic developments and supportive government policies create a unique environment where growth and innovation thrive. At Imobiliare Dubai, we are excited to showcase RAK’s emerging opportunities to our global investors, emphasizing the region’s compelling combination of natural beauty, economic stability, and robust returns.”

The opportunity presented by RAK, has seen developers from around the UAE announce new properties in the emirate, one of which has been DAMAC’s first branded project in RAK, in partnership with Babolex. The luxury development is set to attract high-net-worth individuals and international investors, adding a new layer of sophistication to RAK’s real estate landscape. The project signals a broader trend of luxury developments that cater to discerning buyers looking for exclusivity and high-end amenities.

But the real estate opportunities in RAK are not limited to residential properties. The hospitality sector is also poised for substantial growth, driven by the emirate’s commitment to becoming a leading tourism and leisure destination. A key highlight of RAK’s growing appeal is the upcoming Wynn Al Marjan Island, a multi-billion-dollar integrated resort development set to open in 2026. Positioned on Al Marjan Island with its unparalleled sea views, the resort is expected to drive significant tourist traffic and boost occupancy rates, creating a ripple effect of increased demand for real estate in the vicinity.

As Ras Al Khaimah continues to build on its strengths and attract more global interest, the real estate sector is set to remain a cornerstone of its economic landscape. With new projects on the horizon and a strategic focus on growth and diversification, RAK offers unparalleled opportunities for investors and residents alike, promising a vibrant future filled with potential and prosperity.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Following the devastation of recent flooding, experts are urging government intervention to drive the cessation of building in areas at risk.

This launch follows high demand for Binghatti developments in the area.

Dubai-based property developer Binghatti has unveiled its latest project, Binghatti Royale, located in Jumeirah Village Circle (JVC). This launch follows high demand for Binghatti developments in the area, with previous projects selling out at an impressive pace, some within just 24 hours.

Binghatti Royale stands out with its distinctive circular architectural design and offers 354 residential units, including one- to three-bedroom apartments, along with 16 retail spaces, spread across 47 floors.

“We are thrilled to announce the launch of Binghatti Royale in Jumeirah Village Circle. The rapid sell-out of our recent projects highlights the market’s substantial demand for our projects in the area and we are pleased to introduce our latest creation to meet this demand for premium residences,” stated Binghatti Chairman Muhammad BinGhatti.

With construction reaching advanced stages, the handover of the project is anticipated to fall early in the second half of 2025. Amenities include an infinity pool, private suite pools, a kid’s pool, an outdoor gym and multi-purpose lawn, as well as paddle and tennis courts. The project also features social spaces including a juice bar, an outdoor dining area and lush landscape areas.

Binghatti Royale is located in the heart of the vibrant community of JVC and overlooks Dubai’s Al Khail Road. JVC is known for its family-friendly environment, serene green spaces and wide collection of amenities which has made it one of the fastest growing communities in Dubai.

“Binghatti Royale manifests our commitment to cultivate thriving communities in Dubai like Jumeirah Village Circle and we look forward to launching more projects in the near future to continue delivering exceptional value to our clients and investors,” the Chairman added.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

COO Afzaal Hussain discusses the company’s ambitious expansion plans, construction-driven approach, and commitment to the Dubai 2040 Urban Master Plan.

Azizi Developments has positioned itself as a leading player in Dubai’s dynamic real estate market, delivering thousands of homes to a diverse range of investors and end-users.

In this interview, Mr. Afzaal Hussain, Chief Operating Officer at Azizi Developments, shares the company’s ambitious strategies for growth and expansion, both locally and internationally. He highlights Azizi’s construction-driven approach, its commitment to sustainability and innovation, and how its projects align with the visionary goals of the Dubai 2040 Urban Master Plan.

Additionally, Mr. Hussain provides insights into the company’s expansion into the hospitality sector and its focus on developing investor-friendly properties that promise high returns.

Azizi Developments has made significant strides in Dubai’s real estate market. Can you share your vision for the company over the next upcoming years?

Azizi Developments is a leading developer based in Dubai, UAE. With tens of thousands of homes successfully delivered to local and international investors and end users of over 100 nationalities, we pride ourselves on our extensive portfolio of modern luxury developments across Dubai’s most sought-after residential and commercial destinations, our construction-driven approach, and our commitment to transparency and customer-centricity. Azizi’s residential and commercial properties are investor-friendly, catering to all lifestyles. We have made it our mission to develop lifestyles and enrich the lives of our residents with a focus on catalyzing the vision and development of the markets that we operate in.

We currently have around 40,000 units under construction that are projected to be delivered by 2027, worth several billion US dollars. We are also renowned for developing the world’s second tallest skyscraper, Burj Azizi on Dubai’s Sheikh Zayed Road, and have a strong track record and sizeable project pipeline through our extensive land bank and strategic partnerships with Dubai’s key master developers. We are developing world-class properties in MBR City, Palm Jumeirah, Sheikh Zayed Road, Dubai Healthcare City, Dubai South, Al Furjan, Studio City, Sports City and Downtown Jebel Ali.

We have an ambitious and carefully-planned strategy for the next five years and beyond, centered on extensive construction with a strong emphasis on quality and timely completion. Our plan also includes further expansion in Dubai, with the launch of new communities scheduled in due course.

Moreover, within the next five years, we plan to launch approximately 50 high-end hotels in Dubai, adding around 20,000 keys to the city’s hospitality sector. This expansion is part of our strategy to invest AED 60 billion, primarily through our own capital, allowing us to venture into the hospitality sector.

With plans to expand into multiple international markets, what strategies are Azizi Developments employing to adapt to the different market dynamics in Europe, the USA, and Australia?

Expanding our business verticals internationally is a strategic objective for Azizi Developments. While Dubai has been a key driver of our success and will always be our home, we acknowledge the significance of looking beyond the UAE and are always on the lookout for promising projects worldwide.

We plan to expand further geographically, with the wider GCC region being considered due to the remarkable growth and dynamic nature of its real estate markets. The fast-paced development and increasing demand in the Gulf make it a promising area for our continuation. Plans in these neighboring markets will be announced in due course.

Regarding the future stages of our growth plan, we aim to extend the reach of our hospitality brand to a global scale, much like our development business, which is already present in other markets. We have plans to purchase and develop plots in major metropolitan cities such as Singapore, Hong Kong, Frankfurt, London, and Paris, among others.

Azizi Developments prides itself on its construction-driven approach. Could you elaborate on how this approach has contributed to the company’s success and how it influences your project timelines and quality standards?

Our pursuit of excellence is ingrained in our organizational DNA and has its roots in our construction-driven approach. In off-plan sales, trust is the most pivotal factor: our stakeholders entrust us with their hard-earned money, and it is our duty to ensure that we meet and exceed their expectations at handover.

Being construction-driven is key in this. We have to ensure not only the adherence to pre-set construction timelines and safeguard the swift completion of our projects, but also, and perhaps even more importantly, the quality of the homes that we deliver.

Our reputation is constructed steadily, brick by brick, project by project. Upholding and continuously building upon our reputation is what leads to positive word-of-mouth and repeat purchases, which in turn is reflected in our sales. This is how define our success: true customer satisfaction.

To ensure unmatched quality across our projects, we employ a multi-faceted strategy. Strategic partnerships are fundamental to our success. Through a rigorous procurement strategy, we have built strong collaborations with globally acclaimed suppliers and subcontractors. These partnerships, combined with our robust in-house expertise, ensure our projects provide an exceptional living experience. Our developments go beyond architectural grandeur; they are thoughtfully designed spaces that align with the aspirations of the families who reside in them, contributing significantly to our enduring legacy.

How is Azizi integrating sustainable practices and innovative technologies into its ongoing and future projects?

Dubai’s leadership consistently exemplifies the importance of innovation in sustainability in our rapidly evolving landscape. At Azizi, we are committed to embracing the latest technologies and trends, continuously innovating to maintain our status as the leading private developer in the UAE.

We have doubled down on our sustainability efforts. By incorporating green infrastructure, passive design strategies, and sustainable transportation options into our designs, we are demonstrating that sustainability is achievable even in challenging climates.

We have also enhanced our operational efficiency by implementing several innovative tech/IT solutions, and deployed several new cutting-edge tools, with more currently in development. The use of digital technologies in construction has already drastically transformed the industry in recent years and is expected to continue to evolve and grow.

We have adopted a focus on smart cities, with our new properties all being digitally augmented. Our latest projects all feature smart home systems that allow residents to control and monitor every aspect of their home, granting not only convenience and comfort, but also consumption savings and security.

Moreover, we employ highly advanced artificial intelligence modeling tools, drones for on-site surveillance, and several other profoundly impactful innovations. Leveraging the latest technologies is crucial to our success, as it enhances the efficiency, safety, quality, and sustainability of our work, while more closely aligning with our clients’ rapidly evolving desires and requirements.

Building Information modelling (BIM) software and other digital design tools can help create more accurate and detailed building plans, resulting in identifying and mitigating potential issues early on in the construction process. This can reduce the need for costly rework and change orders later in the project.

Sustainability and energy efficiency are increasingly valued by buyers and investors, becoming a critical aspect of our development process. We now standardly incorporate innovative, energy-efficient concepts and designs into both residential and commercial properties. These include the use of solar panels and LED lighting to reduce electricity use, the construction of green walls, better insulation to lower air conditioning costs, and various other green initiatives that enhance the city’s sustainability.

Future luxury homes in the UAE will feature adaptive and responsive architecture, biophilic design integrating natural elements, and technologically integrated spaces with advanced smart home systems. Sustainable and eco-friendly features like green roofs, rainwater harvesting, and high-performance materials such as self-healing concrete and transparent solar panels enhance both aesthetics and functionality. Advanced insulation, phase-change materials, and modular construction techniques improve energy efficiency and construction precision. Moving forward, 3D printing and robotics will allow for greater customization and complexity in design. These advancements will lead to modern, sleek designs, enhanced comfort, convenience, and flexibility, aligning with the UAE’s commitment to innovation and luxury.

With Dubai’s competitive hospitality market, what will set Azizi’s hotels apart in terms of luxury, service, and customer experience?

A key project in our pipeline, which is expected to elevate our hospitality division, is the 7-star hotel planned for the world’s second tallest tower, Burj Azizi. Strategically located on a prime plot just opposite the World Trade Center on Sheikh Zayed Road, this ultra-luxury hotel will occupy the top thirty floors of the tower.

Currently, we are developing five-star and four-star hotels within the Azizi Venice development in Dubai South, which will feature over 700 rooms and serviced apartments and a range of extensive amenities and F&B offerings. Additionally, we will build a 5-star hotel on the Dubai Islands development, which features 196 rooms across 13 floors, incorporating king and deluxe rooms, as well as executive suites, and a 5-star hotel at Riviera, one of Azizi’s flagship developments located in Meydan at the heart of MBR City, which features over 160 rooms, and serviced apartments across 15 floors.

Further information on the hotel’s amenities and unique value propositions will be announced in due course.

How does Azizi ensure that customer needs and expectations are met across such a diverse range of projects and locations?

Our residential and commercial properties are investor-friendly and cater to all lifestyles. We make it our international mission to develop lifestyles and enrich the lives of those who invest and reside in our properties, and are proud to serve as a catalyst to the vision and development of the markets that we operate in.

Prioritizing our customers’ best interests and keeping these at the forefront is essential to our growth and success. By closely listening to their wants and needs and incorporating these into every decision we make, we are able to provide homes that exceed expectations and deliver some of the best ROIs. We are dedicated to continuously enhancing our offerings to stay aligned with market trends. This involves a continuous process where every development choice—whether it is the location, amenities, design, layout, or construction materials, is carefully assessed and augmented.

How do you navigate the challenges of a rapidly changing real estate market to achieve this goal?

Given our diversified business model, we are well-equipped to navigate any challenges. It fill us with pride to consistently be able to distinguish ourselves through our commitment to delivering high-quality projects that meet and exceed our customers’ expectations. The importance we assign to quality in every sense allows us to continuously be among the top 3 highest-selling developers in Dubai.

Our close collaboration with contractors also accelerates construction timelines and ensures enhanced quality. What also sets us apart from other developers is our unique approach to operations. One key strategy has been the direct sourcing and procuring of construction materials, rather than relying on our contractors doing so.

Azizi Developments has been noted for creating investor-friendly properties. What specific factors do you consider to ensure that your developments provide high yields and return on investment?

We place a strong emphasis on ensuring that our projects are in strategically located, easily accessible, and growth-inclined communities, have world-class build quality, are delivered within specific timelines, have well-thought-through layouts, are distinguished by modern, aesthetic and unique designs, have a wide and comprehensive range of lifestyle enriching amenities, foster a true sense of belonging through social and livable spaces, and offer convenience through various business, leisure and retail hubs in their vicinity. These aspects are key to ensuring customer satisfaction and delivering some of the most outstanding ROIs.

Given the current global economic climate, how do you see the real estate market evolving in the UAE and internationally, and what impact will this have on Azizi’s future projects?

Dubai is at the very forefront of global real estate. The UAE government’s relentless efforts have positioned the country as a premier destination for investors, residents, and tourists alike. Key factors such as the absence of property taxes, high rental yields, competitive pricing per square meter, and the introduction of residency and golden visa programs have solidified its reputation as one of the most attractive cities to live, work, and visit. This upward trajectory, in terms of both investment and as such in property values, we are confident will continue exponentially.

Several pivotal initiatives have been announced to propel Dubai to new heights. Among them, the Dubai 2040 Urban Master Plan, unveiled by His Highness Sheikh Mohammed Bin Rashid Al Maktoum, Vice-President and Prime Minister of the UAE and Ruler of Dubai, which aims to enhance the quality of life for residents and set the stage for major residential and economic advancements in the city. This visionary plan seeks to foster a more sustainable, livable, and inclusive urban environment, necessitating fundamental changes in real estate development and utilization.

The Dubai real estate market is projected to sustain and even accelerate its growth in the coming years. Numerous factors contribute to this, including a robust economy spurring investment, business, job creation, tourism, and housing demand. Due to Dubai’s solid reputation as a secure and stable investment environment, foreign investment remains strong, largely resulting from the many opportunities the emirate holds.

According to urban planners and real estate experts, new communities on the city’s outskirts and more tenants becoming buyers are all on the horizon. We will likely see more residential skyscrapers and premium communities as the population rises from 3.6 million today to a government-projected 5.8 million by 2040.

Furthermore, high rental yields, affordability, relaxed visa policies, and long-term sustainable development plans have made the UAE emerge as a favorite among international investors. These factors have attracted a diverse spectrum of investors, from high-net-worth individuals and institutional investors to sovereign wealth funds, all seeking a steady income stream and significant potential for capital appreciation.

From a return standpoint, Dubai offers a competitive edge with an annual ROI of 8.4% and above, outshining many global cities. Its position as an investment destination, with relatively low square foot prices compared to the world’s other top 25 cities enhances its appeal, especially when paired with the strength of the Emirati Dirham (AED) — a boon for investors from nations with weaker currencies.

Azizi has consistently supported the vision of Dubai’s leaders. How do your projects align with the broader goals of the Dubai 2040 Urban Master Plan?

The UAE stands out as a beacon of rapid progress, propelled by its leadership’s decisive actions. The agility demonstrated in the nation’s advancement, combined with its robust regulatory and legal framework, is truly commendable and a cornerstone of its success. This dynamic environment fosters a fertile ground for business, attracting Foreign Direct Investment (FDI) from across the globe.

The Dubai 2040 Urban Master Plan, unveiled by His Highness Sheikh Mohammed Bin Rashid Al Maktoum, Vice-President and Prime Minister of the UAE and Ruler of Dubai, aims to enhance the quality of life for residents and set the stage for major residential and economic advancements in the city. This visionary plan seeks to foster a more sustainable, livable, and inclusive urban environment, necessitating fundamental changes in real estate development and utilization.

Azizi’s projects prioritize sustainability, incorporating green building practices, energy-efficient technologies, and open spaces with an abundance of unique features, including some of the world’s largest swimmable crystal lagoons, a vast amount of recreational and leisure activities, and even an opera, such as in Azizi Venice, that promote community well-being. Our developments are designed to integrate seamlessly into the city’s evolving landscape, yet setting them apart, contributing to Dubai’s goal of becoming the best city to visit, live and work. By focusing on mixed-use developments that combine residential, commercial, and recreational spaces, we foster communities that align with the broader urban vision.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

The Project seamlessly blends British architectural elegance with innovative environmental technology

LEOS Developments announced about its latest project, Knightsbridge, with a gross development value of AED 1.75 billion, situated in the prime location of Meydan’s District 11.

This project aims to redefine luxury living by introducing Dubai’s first climate-adaptive wellness community, merging classic British architectural sophistication with cutting-edge environmental technology.

The phase one of Knightsbridge will feature an exclusive collection of 66 premium properties, including 4-bedroom townhouses and 5 and 6-bedroom villas, all meticulously designed to embody the highest standards of luxury and sustainability.

- The Highclere 4-Bedroom Townhouses: with plot areas ranging from 1,853 – 4,191 sq.ft and built-up areas spanning 3,937 – 3,971 sq.ft, these townhouses are perfect for families.

- The Grosvenor 5-Bedroom Villas: with plot areas ranging from 4,478 – 7,722 sq.ft and built-up areas spanning 5,657 sq.ft, these villas provide ample space for luxury living, featuring expansive layouts and premium finishes throughout.

- The Balmoral 6-Bedroom Signature Villas: With plot sizes spanning 7,131 – 8,717 sq.ft and built sizes offering 7,260 sq.ft of living space, these grand villas epitomize luxury, featuring exquisite design, private gardens and world-class facilities.

All townhouses and villas at Knightsbridge are designed with luxury and convenience in mind, featuring private pools, fresh harvest gardens, private elevators, smart home systems and climate-controlled outdoor shaded terraces. For an elevated experience, the villas offer private Jacuzzis, maid and driver’s rooms, chef and show kitchens and a private cinema.

The first phase covers a total plot area of 335,877 square feet with 70% of green spaces. This groundbreaking development will offer residents a unique living experience centered around wellness, luxury, and environmental harmony. The master plan, developed in collaboration with Nakheel and Meydan, is meticulously crafted to ensure a perfect balance between urban living and natural surroundings.

“Our vision for Knightsbridge is to create a sanctuary where residents can experience the pinnacle of luxury while living in harmony with nature,” said Mark Gaskin, COO of LEOS Developments. “We are thrilled to bring this innovative concept to life in Dubai, a city that continues to set the benchmark for global real estate development.”

Knightsbridge’s design is inspired by classic British architecture, featuring distinct elements such as bay-view popped-out windows, curvy lines for optimal climate control and a harmonious blend of yellow stone and metal cladding. This attention to detail ensures that every home is not just a residence, but a masterpiece of design and sustainability.

Knightsbridge is Dubai’s first climate-adaptive wellness community, where every aspect of the development is crafted to adapt to the unique climate of the region. Climate adaptable and sustainable features include an abundance of green spaces, solar panels, a re-oxygenating waterfall, self-shading building terraces, smart home system, EV charging facilities, solar water heating, energy efficient LED lighting, UV-proof double glazing, an insulated building envelope, a smart irrigation system, greywater recirculation using UV filters, and biodegradable reed-bed filtration for lake water. Residents will have access to world-class amenities designed to enhance their well-being, including a lagoon, a running track, a Japanese Rapha Yoga deck, a Stargazing Tea Lounge, an outdoor cinema, and much more.

Knightsbridge by LEOS is strategically located just a three-minute walk from the swimmable lagoon, providing residents with direct access to Dubai’s main highways E66 and E311. This prime location ensures that while residents are away from the hustle and bustle of the city, they remain easily connected to all that Dubai has to offer.

With a key focus on sustainability and luxury, Knightsbridge is set to become a landmark development in Dubai, offering an unparalleled living experience for those seeking the very best in life.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Santorini Residences is A modern, Greek-inspired development focused on sustainability.

Dubai’s real estate sector is undergoing a rapid revival, attracting numerous international developers since the start of 2023. This surge is closely linked to a dramatic rebound in the real estate market, as highlighted by the SAVILLS World Housing Cities Index.

Loutraki, an Australian real estate developer operating under Nucorp Constructions, launched the “Santorini Residences” in Dubai. This luxury residential project stands as a model of sustainability, featuring modern green-friendly specifications.

According to the company’s statement, the Santorini Residences adds to Loutraki’s portfolio of global luxury developments, which began in 2011 with projects such as Woolley Creek, Rosehill, Parramatta, and Merrilands in Sydney, Australia.

The anticipated Santorini Residences, set for completion in July 2026, will further this legacy. Located in District 2 of Jumeirah Village Triangle (JVT), the Santorini Residences is poised to be one of Dubai’s most distinguished residential developments. Spanning 22 floors, it offers a variety of units, including studios, one-bedroom, and two-bedroom apartments, catering to the needs of families and investors alike.

Mr. Ahmed Karim, CEO & Founder of AMK VISION, the exclusive real estate broker for marketing the project, said: “The value of the project is AED 200 million.” He added: “Dubai is an ideal destination for real estate investment from Europe, America and the world, expecting the emirate to experience a dramatic growth in real estate prices of 5% 7% annually in 2024 and 2025, driven by higher demand than available supply.”

The Santorini Residences project offers investment opportunities and luxury residential benefits that meet the aspirations of investors and families, especially in view of the continued growth in demand for luxury properties, which, according to him, enhances the position of a company “Loutraki” as a global leader in sustainable real estate development, constitutes a major step towards building vital environmentally friendly communities.

He also highlighted that the “Santorini Residences” project was aimed at achieving the principles of green construction. To serve the UAE’s vision for sustainability, the Emirate of Dubai in particular seeks to increase the ratio of green buildings to 25% by 2030. The project comes in line with this vision, reflecting Dubai’s commitment to providing sustainable housing projects.

He also mentioned that the project “Santorini Residences” offers amenities and entertainment from swimming pools, a fitness center, green spaces.

Santorini Residences represents more than just a housing project; It is a reflection of Dubai’s future vision in the real estate sector with high demand and investment in luxury residential spaces.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

This will allow tenants to convert traditional annual rent payments into manageable monthly instalments.

Rize has been granted Sharia certification by the Shariyah Review Bureau (SRB), a prominent provider of Sharia advisory services. This certification marks a pivotal achievement for Rize, which is focused on revolutionizing the rental market through its cutting-edge payment solutions.

Rize has introduced a unique financial model that enables tenants to convert their traditional yearly rent into more manageable monthly instalments. This approach significantly eases tenants’ initial financial strain while ensuring landlords receive the entire annual rent upfront, providing them with immediate liquidity and reducing vacancy periods. This model aligns seamlessly with the goals of Saudi Vision 2030.

Ibrahim Balilah, CEO and Co-founder of Rize, remarked on the inception of this model: “We recognized the challenges in the traditional rental market, where upfront annual payments posed barriers for many. Our solution not only addresses this issue by improving tenant access to housing but also guarantees landlords a consistent income stream.”

To ensure that its operations comply with Islamic finance principles, Rize collaborated with the Shariyah Review Bureau, known for its extensive expertise and diverse clientele across the financial sector. The certification from SRB attests to Rize’s steadfast commitment to adhering to Shariah principles in all aspects of its operations.

Yasser S. Dahlawi, CEO of Shariyah Review Bureau, stated, “Our collaboration with Rize underscores our commitment to supporting innovative solutions within the real estate sector that comply with Sharia standards. We are proud to be part of a movement that not only fosters financial inclusivity but also contributes to the economic objectives of Saudi Arabia.”

With this certification, Rize is well-positioned to establish a new benchmark for property rentals, offering a financially inclusive option that benefits all stakeholders and supports the burgeoning real estate fintech sector.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

MIDORA Residences will deliver a green oasis with proximity to modern and transport links.

QUBE Development, a renowned international real estate developer with 30 years of experience, has announced the launch of sales for MIDORA Residences, as part of its AED 2.6 billion property portfolio. Situated in the vibrant and sought-after community of Jumeirah Village Circle (JVC), this new development emphasizes QUBE’s commitment to providing elegant units with green spaces and convenient amenities to cater to modern life. MIDORA Residences, designed by the award-winning Japanese architectural firm Nikken Sekkei behind One Zabeel Tower, features 492 spacious units including apartments and duplexes.

Located in District 13 of JVC, MIDORA Residences embodies a green urban oasis, surrounded on three sides by parks, and seamless connectivity to major landmarks, including airports and key highways. This prime location is further bolstered by the development plans for Al Maktoum Airport (DWC). The area is also a prominent market and one of the most popular within the Dubai Southeast submarket, emerging as the number one choice for families and investors alike. JVC was Dubai’s top performing area for property sales in Q2 2024 with 1,594 transactions amounting to approximately AED 1.41 billion according to figures published on DXB Interact.

Project Director of MIDORA Residences, Alisa Novokhatko, commented: “A strong response from local and international investors reaffirms Dubai’s demand for thoughtfully designed, green living spaces. Interest in MIDORA Residences highlights the long-term investment potential of JVC. This project is designed to cater to the needs of residents, with integrated cutting-edge features and meticulously planned amenities to ensure that MIDORA Residences stands out as the future of urban living.”

MIDORA Residences features a dedicated Children’s Developmental Area along with indoor and outdoor playgrounds, providing a safe space for children to learn and play. Residents can benefit from a range of wellness facilities, including one of the largest swimming pools in JVC, a professionally equipped gym, and yoga rooms. Professionally managed, premium office spaces are an elevator ride away, allowing you to balance work and family time effortlessly. The comprehensive facilities provide each resident with the services needed to unwind and enhance the quality of living. A personalized 24-hour concierge service is a key part of the development’s commitment to the comfort of its occupants while access to a unique 350m of lush scenic green walkways and private BBQ areas fosters a sense of community. Units are fully equipped with premium quality kitchen appliances and a smart home system that simplifies daily routines.

Investing in Dubai’s real estate market brings numerous benefits, including eligibility for long-term residency and competitive payment plans on off-plan properties, which have surged by 61.4% in sales year on year and equivalent to AED 59.9 billion as highlighted by the ValuStrat Dubai Real Estate Review. MIDORA Residences by QUBE Development represents a new era of high-quality urban living. Attracting residents and investors with its prime location, family-friendly amenities, and commitment to eco-conscious living. MIDORA Residences is set to become a landmark development in Jumeirah Village Circle.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

The project will implement cutting-edge smart energy management systems, water-efficient fixtures and many other sustainable features

SOL Properties has officially started construction on the premium residential ‘Fairmont Residences Solara Tower Dubai,’ marking a significant step in enhancing the regional real estate market. This residential project is designed with a strong focus on green building standards and cutting-edge energy-efficient technologies.

As part of Fairmont Hotels & Resorts, a renowned global luxury hotel brand under the Accor group, Fairmont Residences Solara Tower Dubai will introduce a new level of sophistication, unforgettable experiences, and genuine service to the dynamic city of Dubai. Fairmont will oversee the project’s design to reflect its brand values, providing residents with exclusive privileges. Homeowners will benefit from access to an array of integrated services and high-end amenities, such as a private swimming pool, fitness center, and spa, creating a hotel-like atmosphere within the comfort of their residences, solidifying the tower as a landmark in the city.

Furthermore, this groundbreaking project showcases Fairmont and SOL Properties‘ enduring dedication to sustainable development, aligning with the UAE’s Green Agenda 2030 and strengthening the country’s reputation as a global leader in sustainability.

The ‘Fairmont Residences Solara Tower Dubai’, a premium residence for upscale urban living, uses sustainably sourced and highly efficient materials such as post-tension slabs to reduce material cost while enhancing structural integrity. Similarly, it harmonises opulence and functionality by leveraging prefabricated steel structural components that facilitate speedy on-site assembly, reduce construction time, enhance precision and promote environmental preservation by limiting power use and waste production.

In addition, the project will also feature self-shading balconies to reduce the need for air conditioning and electric-powered lights, thus reducing utility bills and carbon footprint, ensuring a superior lifestyle for all residents. Advanced technologies, such as Building Information Modeling (BIM), are being utilized to enhance the project’s overall efficiency.

Ajay Bhatia, Founder and CEO of SOL Properties, said: “We, at SOL Properties, strive to elevate UAE residents’ quality of life by synergizing luxury and sustainability. In recent years, we have witnessed remarkable growth in the demand for sustainable luxury residences within the UAE as luxury homebuyers are increasingly seeking residences that align with their environmental values without compromising on comfort and design. Hence, we remain committed to catering to the evolving demands of our clients by employing innovative designs and eco-friendly practices that enhance the luxury living experience. We are pleased to reveal that the construction of the ‘Fairmont Residences Solara Tower Dubai’ is expected to be completed by Q4 2027.”

The project utilizes advanced software and hardware technologies that streamline design, planning and coordination to minimize errors, enhance project management and uphold sustainable standards.

Moreover, the building’s private units and communal areas will feature lush, green spaces, with plants that require minimal maintenance. The project’s exemplary landscaping will help enhance air quality, elevating the environment’s ecological health, while offering stunning panoramic views of Dubai’s cityscape. It will also feature cutting-edge smart energy management systems and water-efficient fixtures that promote a sustainable lifestyle.

With a legacy of 20 years, Sol Properties has delivered several world-class projects, consolidating its stature as a leader in the luxury property landscape. The company’s portfolio encompasses an eclectic array of exquisite residential developments and commercial spaces that converge sustainability and architectural brilliance.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Unique Properties has secured 36% of its transactions in this segment, since January 2024

Unique Properties has expanded its presence in the secondary market. Since January 2024, the company has achieved 36% of its transactions in this segment and to further drive growth and strategic initiatives in this dynamic area, Chris Jones and André Henry Watson have joined as Sales Directors, bringing their extensive expertise to the leadership team.

The addition of Chris and André to Unique Properties’ leadership reflects a key milestone in the company’s strategic expansion, particularly in Dubai’s secondary market, which accounted for 41% of total transactions in 2023, according to Deloitte’s Real Estate Predictions 2024.

With 17 years of experience across UK and UAE real estate, including 15 years in management, Chris Jones recognized the potential growth and established the secondary market division at Unique Properties less than a year ago, and now leads a team of over 30 real estate agents. Known for his ability to drive sales growth and expand market share, he is responsible for crafting and executing innovative sales strategies, setting ambitious targets, and mentoring his team to achieve exceptional results. His disciplined, target-oriented approach, combined with exceptional planning and organizational skills, will be key in seizing opportunities in high-demand areas like Downtown, Business Bay, Dubai Creek Harbour, Dubai Marina, Palm Jumeirah, Arabian Ranches, Emaar South, Emirates Living, Jumeirah Living and the townhouse communities surrounding the Al Qudra Road.

In his first year as an agent, Chris was recognized as one of the top 2 agents out of over 100, showcasing his remarkable sales acumen. His achievements include receiving the Manager of the Year award in 2009 and orchestrating one of the largest leasing deals in Dubai in 2016. He has a proven track record of developing talent, having successfully guided brokers from trainee roles to managerial positions and trained numerous real estate professionals who have gone on to become managers themselves. Since 2010, he has led over 200 brokers, reflecting his supreme leadership and ability to drive success in the industry.

André Henry has built a remarkable reputation for his exceptional negotiation skills and leadership in the real estate industry, managing sales teams at some of Dubai’s top real estate firms. With over seven years of experience in both the UK and UAE, he brings a deep understanding of sales management, teamwork, customer experience, and business development. His strategic approach and ability to elevate team performance have consistently delivered impressive results. Known for his professionalism and keen insight into client needs, André is set to drive substantial growth and success in the competitive Dubai secondary real estate market, leveraging his extensive background to enhance team effectiveness and achieve outstanding outcomes.

Commenting on the new leadership team, Armin Jalili, Partner, and Board Member of Unique Properties said, “The secondary market offers immense opportunities for growth, with Chris and André leading the charge, we are confident in our ability to expand our presence in this critical market segment. Their leadership will be pivotal in helping us connect more buyers with the exceptional properties Dubai has to offer, further cementing our position as one of the leading brokerage firms in the industry. Chris and André’s expertise will also significantly influence Dubai’s real estate market, driving innovation and excellence”.

Further enhancing its performance in the secondary market, Unique Properties will capitalize on its state-of-the-art CRM system, which incorporates years of scrupulously curated buyer data, allowing the company to more effectively penetrate the secondary market. This technology not only streamlines client interactions but also improves the ability to quickly match buyers with suitable properties. By leveraging this comprehensive database, Unique Properties can better predict market trends and client preferences, delivering a more personalized and efficient service. Alongside the introduction of its dedicated call center in October 2024, this technological advantage positions the company as a key player in the secondary real estate market.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Units crafted in collaboration with luxury collection BABOLEX by Vincent Faudemer.

DAMAC Properties has unveiled its first project in Ras Al Khaimah – Shoreline by DAMAC, set on the stunning shores of Al Marjan Island. This exclusive, branded beachfront residence is being crafted in partnership with contemporary art icon Vincent Faudemer’s luxury collection, BABOLEX, seamlessly blending funky and chic details to create a modern yet comfortable living environment. Shoreline by DAMAC represents the developer’s second collaboration with BABOLEX, following the successful Coral Reef by DAMAC project in Dubai.

This new development underscores DAMAC’s dedication to creating exceptional living spaces that marry elegance with serenity. Located in the prime area of Island 4 on Al Marjan Island, the luxury 1-, 2-, and 3-bedroom apartments and duplexes will offer a five-star resort experience with direct beach access. Shoreline by DAMAC is designed to provide residents with breathtaking, unobstructed views of the Arabian Gulf, complemented by top-of-the-line amenities including landscaped gardens, fitness centers, running tracks, swimming pools, wellness areas, a sunset bar, and a floating cabana, all within a tranquil and sophisticated setting.

Mohammed Tahaineh, General Manager of Projects at DAMAC, said: “We are thrilled to bring our expertise and commitment to unparalleled luxury and excellence to Ras Al Khaimah, an emirate that is fast-emerging as a premier destination for residents, holiday homeowners, and investors alike. Shoreline by DAMAC is more than just a residential development; it embodies the aspirations and goals of the UAE’s evolving population. What sets our new development apart is its prime waterfront location, with convenient proximity to some of the region’s most exciting attractions, combined with our exclusive architecture and collaboration with BABOLEX. This partnership brings innovation and art-inspired living spaces that blend comfort and sophistication.”

DAMAC Properties’ expansion into Ras Al Khaimah aligns with the emirate’s rapid rise as a leading destination for expatriates and home investors. According to the 2023 Expat City Ranking, Ras Al Khaimah is now recognized as the world’s fourth-best city for expatriates to live and work due to its high living standards and job opportunities. The government’s supportive initiatives, regulations, and residency eligibility have further fueled demand for residential properties, particularly apartments, making the city increasingly attractive to investors and those seeking holiday homes amidst its natural beauty. Shoreline by DAMAC is set to meet this demand, offering luxury apartments tailored to the needs of modern residents and discerning investors.

Since 2002, DAMAC Properties has led the luxury real estate sector in the Middle East, delivering iconic residential, commercial, and leisure properties across the region. The launch of Shoreline by DAMAC in Ras Al Khaimah marks a significant milestone in the company’s journey and is in line with its broader vision to create properties that harmonize with their natural surroundings while incorporating the latest technology and design innovations.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Alexandre de Betak and his wife are focusing on their most personal project yet.

An opportunity could be on the horizon for those who deferred a home purchase in some of the luxury real estate markets that boomed during the pandemic as demand falls.

Among them, the Miami and Naples areas of Florida; urban Honolulu; and Santa Fe, New Mexico, could be among the best luxury markets in the U.S. for buyers this fall, according to data Realtor.com provided to Mansion Global. The data was staked on a combination of falling luxury median price points, which indicate markets that are softening and where buyers could potentially score a deal; a shift in median days on market; and page views, with fewer views indicating less demand.

“We see that these higher-priced markets are seeing falling demand,” said Hannah Jones, senior economic research analyst at Realtor.com . “And so for buyers who do have access to the capital that they could purchase in one of these markets, they may find more flexibility than in some of the markets that are lower priced and are still seeing a ton of competition.”

Read on for where the opportunity lies and advice in those markets from real estate agents on the ground.

Miami, Fort Lauderdale and Pompano Beach, Florida

Buyers who couldn’t get enough of the sandy shores of this trio of South Florida cities during the pandemic have largely backed off, making it the No. 1 destination for luxury buyers this fall.

The luxury median listing price in Miami, Fort Lauderdale and Pompano Beach was down 22% to $2.5 million in the second quarter. Between June 2023 and June 2024, the median days on market for luxury listings rose five days and in the same time page views of luxury properties on Realtor.com fell a whopping 44%.

Mick Duchon, a Miami-based agent with Corcoran, said that some sellers who were stuck in the high-price mindset of 2021 and part of 2022 are starting to come around, meaning there are still properties out there with a listing price ripe for an adjustment. He said it’s an opportunity for people who have been waiting on the sidelines.

Case in point, Duchon was working with a buyer on a penthouse apartment in the South of Fifth neighbourhood in the summer of 2022, when the market had just started to adjust from its pandemic highs. After approaching the seller with a deal and agreeing on it, the buyer decided to wait. undefined undefined “Two years later, we transacted at 15% below that initial contract price,” on the same penthouse with the same buyer and seller, he said.

He added, “If buyers are basing their offers on what has transacted recently, then they should be able to achieve a solid deal.”

Pixabay

Honolulu

Realtor.com found that the median luxury listing price in Honolulu fell nearly 10% to $2.34 million in the second quarter. In June, the median days on market for luxury listings fell 11 days compared to a year ago, while in the same time frame, luxury page views fell 31%, indicating less interest, making Honolulu the No. 2 market for buyers this fall.

Noel Shaw, an agent with Hawai’i Life Real Estate Brokers Forbes Global Properties, said the peak Covid rush to Honolulu has abated somewhat, but other buyers who decided to change their lifestyle and move there as part of their 10-year plan are still trickling in. It’s keeping competition up for those mid-tier luxury listings and makes it imperative to work with an agent who knows the city like the back of their hand. (Shaw grew up in Honolulu, and said the quality of real estate varies block by block.)

“This is an island, the city’s very limited so we still have a limited supply,” she said. “So while there are going to be some great deals within the city, it’s not going to be as easy or obvious as other cities.” undefined undefined The listings luxury buyers should keep an eye out for are the top-tier properties of Japanese sellers, she said. Honolulu is a prestigious second-home market for Asians, Shaw said, but the weakness of the yen right now means that some Japanese owners may choose to sell and convert their funds back to yen. Those prized properties, which are rare in Honolulu because of the constraints on inventory, are the extra sweet spot for luxury buyers looking for top-of-the-line properties these days, she said.

Naples-Marco Island, Florida

The market frenzy has quelled in this Gulf Shore slice of Florida, with the luxury median listing price down 18% to $4 million in the second quarter. The median days on market over the year ending June is the same as the year prior, at 85, but page views on luxury properties are down over 11% in the same time period, bringing the Naples-Marco Island metro into the No. 3 spot. undefined undefined “We’re over the Covid mania, where people came and purchased properties at any price,” said Celine Wells, an agent with Douglas Elliman. “What we’re seeing now is less volume of sales, but very strong sales.”

For potential buyers, “patience is a virtue,” said Chris Wells, Celine’s business partner and husband. Chris added it’s important to have knowledge of the market so you can act quickly when a particularly interesting property comes to market. Most transactions happen in cash, with mortgages brought into the picture post-closing, he said.

He added, “A nice deposit, a quick closing, a cash deal, a short due-diligence period—these are things that help a buyer get the property they desire.”

Pixabay

Santa Fe, New Mexico

The Sunbelt and Mountain West experienced huge demand in recent years, and the small in-between market of Santa Fe was not immune to that.

Unlike the other cities on this list, demand is still up there, with luxury page views surging nearly 7% and luxury median days on market falling 33 days, to 86, between June 2023 and June 2024. Prices, however, are trending down, with the luxury median listing price having fallen nearly 14% to $2.98 million from April to June. All together, it makes Santa Fe the fourth-best market for luxury buyers this fall. undefined undefined “People are still wanting to come here. Santa Fe is still very, very desirable,” said Ricky Allen of Sotheby’s International Realty – Santa Fe Brokerage. “They’re coming for the size of the city, the climate, the culture, the lifestyle. … I think it’s a good time to be a buyer.” undefined undefined Allen suggested that buyers see as many properties as possible that check most of their boxes. “You never know what those properties are going to end up selling at,” he added.

(Mansion Global is owned by Dow Jones. Both Dow Jones and Realtor.com are owned by News Corp.)

This article was originally published on Mansion Global.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Sydney’s prestige market is looking up, here’s three of the best on the market right now.

Owned by Richard Outten, who’s penned screenplays for films including “Pet Sematary Two” and “Lionheart,” this is only the third time the home has been on the market

A Mid-Century Modern home in Carmel, California, hit the market on Friday for just the third time in 70 years with a listing price of $4.25 million.

Located in the community of Carmel Highlands, the house is just steps from the coastline and comes with private beach access, according to the listing with Tim Allen of Coldwell Banker Realty in Northern California. Allen was not immediately available for comment.

The property last changed hands in 2010 when Hollywood screenwriter Richard Outten bought it for $990,000, public records show. Outten penned the screenplays for the 1992 movie “Pet Sematary Two” and the 1987 film “Lionheart,” and created the story for the 2012 “Journey to the Center of the Earth” sequel, “Journey 2: The Mysterious Island.” He was not immediately available for comment.

Built in 1953, the home’s mid-century charm has been preserved over the years while still being updated for modern living. Interior details include wood paneling, exposed-brick walls and beamed ceilings.

The single-level house has 1,785 square feet, which includes three bedrooms and two full bathrooms. Though not directly on the water, large windows flanking the adobe-brick, wood-burning fireplace look out at the ocean.

Sliding glass doors create a seamless flow between indoor and outdoor living. Outside, there’s a large patio surrounded by lush landscaping, and there are also meandering paths through sustainable succulent gardens, according to the listing.

In addition to its close proximity to the beach, the home is a 10-minute walk from downtown Carmel-by-the-Sea.

As of July, the median list price in Carmel is $3.1 million, up 8% from last year, even as active listings have increased 50% year over year, according to data from Realtor.com.

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

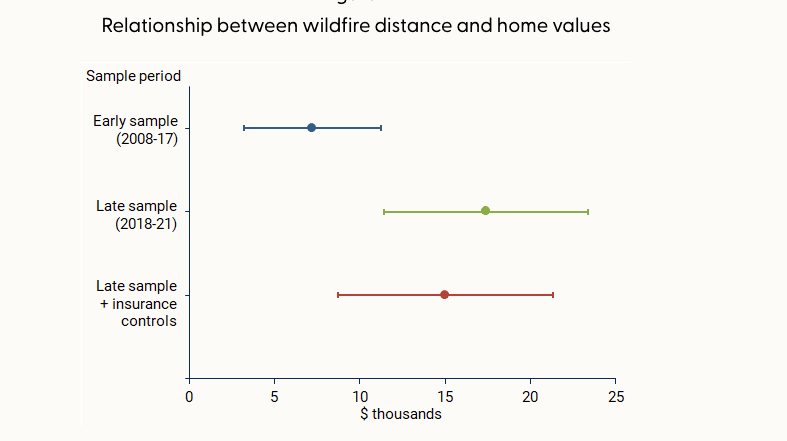

Report by the San Francisco Fed shows small increase in premiums for properties further away from the sites of recent fires

Wildfires in California have grown more frequent and more catastrophic in recent years, and that’s beginning to reflect in home values, according to a report by the San Francisco Fed released Monday.

The effect on home values has grown over time, and does not appear to be offset by access to insurance. However, “being farther from past fires is associated with a boost in home value of about 2% for homes of average value,” the report said.

In the decade between 2010 and 2020, wildfires lashed 715,000 acres per year on average in California, 81% more than the 1990s. At the same time, the fires destroyed more than 10 times as many structures, with over 4,000 per year damaged by fire in the 2010s, compared with 355 in the 1990s, according to data from the United States Department of Agriculture cited by the report.

That was due in part to a number of particularly large and destructive fires in 2017 and 2018, such as the Camp and Tubbs fires, as well the number of homes built in areas vulnerable to wildfires, per the USDA account.

The Camp fire in 2018 was the most damaging in California by a wide margin, destroying over 18,000 structures, though it wasn’t even in the top 20 of the state’s largest fires by acreage. The Mendocino Complex fire earlier that same year was the largest ever at the time, in terms of area, but has since been eclipsed by even larger fires in 2020 and 2021.

As the threat of wildfires becomes more prevalent, the downward effect on home values has increased. The study compared how wildfires impacted home values before and after 2017, and found that in the latter period studied—from 2018 and 2021—homes farther from a recent wildfire earned a premium of roughly $15,000 to $20,000 over similar homes, about $10,000 more than prior to 2017.

The effect was especially pronounced in the mountainous areas around Los Angeles and the Sierra Nevada mountains, since they were closer to where wildfires burned, per the report.

The study also checked whether insurance was enough to offset the hit to values, but found its effect negligible. That was true for both public and private insurance options, even though private options provide broader coverage than the state’s FAIR Plan, which acts as an insurer of last resort and provides coverage for the structure only, not its contents or other types of damages covered by typical homeowners insurance.

“While having insurance can help mitigate some of the costs associated with fire episodes, our results suggest that insurance does little to improve the adverse effects on property values,” the report said.

While wildfires affect homes across the spectrum of values, many luxury homes in California tend to be located in areas particularly vulnerable to the threat of fire.

“From my experience, the high-end homes tend to be up in the hills,” said Ari Weintrub, a real estate agent with Sotheby’s in Los Angeles. “It’s up and removed from down below.”

That puts them in exposed, vegetated areas where brush or forest fires are a hazard, he said.

While the effect of wildfire risk on home values is minimal for now, it could grow over time, the report warns. “This pattern may become stronger in years to come if residential construction continues to expand into areas with higher fire risk and if trends in wildfire severity continue.”

Chris Dixon, a partner who led the charge, says he has a ‘very long-term horizon’

Self-tracking has moved beyond professional athletes and data geeks.